Features

Best Budget Smartphones below $300 (August 2017 Edition)

Welcome to GadgetMatch’s list of the best smartphones priced below $300! Each month, we update our selection with the budget-friendly phones we believe are most deserving of your hard-earned savings.

Even though the spotlight has been on high-end smartphones this entire year, there have been a few surprisingly good entry-level handsets coming out lately, as well. So good, in fact, that we had to reassess our entire list.

Here they are in no particular order:

Huawei GR3 2017 / Honor 8 Lite ($180)

As much as we enjoyed having Huawei’s GR5 2017 (also known as the Honor 6X) on this list, we couldn’t help but replace it with its more affordable sibling, the GR3 2017 (confusingly called the Honor 8 Lite in some regions). You can never go wrong with a midrange chipset and premium-looking body in a sub-US$ 200 handset.

OPPO A57 ($240)

Now that OPPO’s F series belongs in the midrange category of our lists (the recently launched F3 is valued above $300), it’s up to the A57 to be the gateway into the Chinese company’s portfolio. Armed with an efficient Snapdragon 435 processor, selfie-centric front camera, and speedy fingerprint scanner, the A57 is OPPO’s best budget bet.

ASUS ZenFone 3 Max 5.5 ($200)

ASUS has been releasing ZenFone 3 variants like there’s no tomorrow, but the one offering the most value for the price is the 5.5-inch ZenFone 3 Max. It’s the larger version of the original ZenFone 3 Max, and borrows the faster camera of the ZenFone 3 Laser.

REVIEW: ASUS ZenFone 3 Max 5.5

Xiaomi Redmi Note 4X ($200)

We finally had to take out Xiaomi’s Redmi 4 Prime on this list to make way for the Redmi Note 4X. It’s bigger and more fun to play with; plus, it has all the same features we loved from its smaller sibling, including the large battery, efficient processor, and solid build quality.

Vivo Y53 ($120)

When you talk about great value, you must include Vivo’s Y53. Despite having no fingerprint scanner, its processor and build quality are among the things you used to find on phones twice the price of this handset — truly a serious consideration when you can’t spend more than $140.

[irp posts=”15603″ name=”Best Budget Smartphones below $300 (July 2017 Edition)”]

In case you’re wondering, it’s pronounced /pyu-ra/. And it’s more than just a name change. All four models of the Pura 70 series come with a set of cameras that will make your jaw drop. Though it’s not the most impressive Ultra, the Huawei Pura 70 Pro is still capable of shooting breathtaking photos all by itself.

Arranged like a hidden Mickey, the Pura 70 Pro’s camera island features a triple threat of cameras, highlighted by a vastly improved telephoto lens when compared to the regular model.

- 50-megapixel f/1.4-4.0 25mm main

- 48-megapixel f/2.1 93mm 3.5x optical telephoto

- 5-megapixel f/2.2 13mm ultrawide

A Huawei-filled stay in China

While there are different brands operating in the region, Shenzhen is a much bigger playground for Huawei. The brand maintains multiple flagship stores and a sprawling campus there.

Our first stop was the first global flagship store for Huawei. The building features a huge central area, a lineup of cars, and, of course, spots to try the brand’s latest innovations.

As you’ve probably read from our first impressions, one of the most iconic demonstrations during the entire trip was of a spinning picture disc of a surfer frozen in time by the Pura 70 Pro’s Snapshot mode.

Mixing it up at MixC

While the previous store was impressive, it didn’t show just how popular Huawei was in China. Luckily, our next stop was in the center of a sprawling shopping center called MixC. This location had lots of cafes and shops nearby.

The branch itself features a 24-hour vending machine, a stage for lessons on how to use Huawei’s products, a smart home demonstration, and a third floor for aftermarket solutions (or even just to chill). Take a peep at how many people are in the store to try out Huawei.

Being in the middle of the city, it was also the perfect spot to try out the smartphone’s impressive zooming capabilities. Zooming into the city’s buildings, the camera captured far-away balconies to virtual perfection.

A little bit of nightlife

Speaking of the city, what would a trip be without some local nightlife? Early in the night is filled with commuters going home, night vendors peddling their wares, and lots of motorcycles.

Though the city sleeps earlier than more bustling metropolises, Shenzhen’s late night still makes for some subdued scenes and gentle nightscapes.

Oh, and how about some astrophotography?

Huawei’s campus or a European wonderland?

The next day, we went to Huawei’s massive headquarters in Shenzhen. Now, to call it “massive” is still an understatement. Supported by its own transit system, the campus features multiple “regions” inspired by architecture from different European countries.

Oh, and in case you missed it, yes, it has its own train. Excuse us; it’s time to head to Hogwarts.

There’s a big lake that boats can pass through. And, if you’re lucky enough, you might be able to spot a few black swans swimming around.

Goodbye, China

Unfortunately, all good trips must come to an end. We’re not saying goodbye until we use the Pura 70 Pro up, up in the air, though.

How impressive can a camera get?

A few years ago, I used the Huawei P20 Pro as my daily driver. Since then, I’ve moved on to the Google Pixel 6, a capable shooter in its own right. However, the Pura 70 Pro just made me fall in love with smartphone photography — nay, photography, in general — all over again.

The camera is just a beast in most shooting conditions. Plus, the AI-based enhancement is the cherry on top. Because the enhancements take a second, you can quickly see a before-and-after comparison. Some adjustments are minute, but they’re all substantial enough to make all the difference. Plus, you can barely notice the manipulation.

Okay, granted: it’s not perfect. There are some shots where the AI enhancement is more blatant. It also favors warmer hues in some conditions. But overall, it’s an amazing camera that I’m having a blast experimenting with.

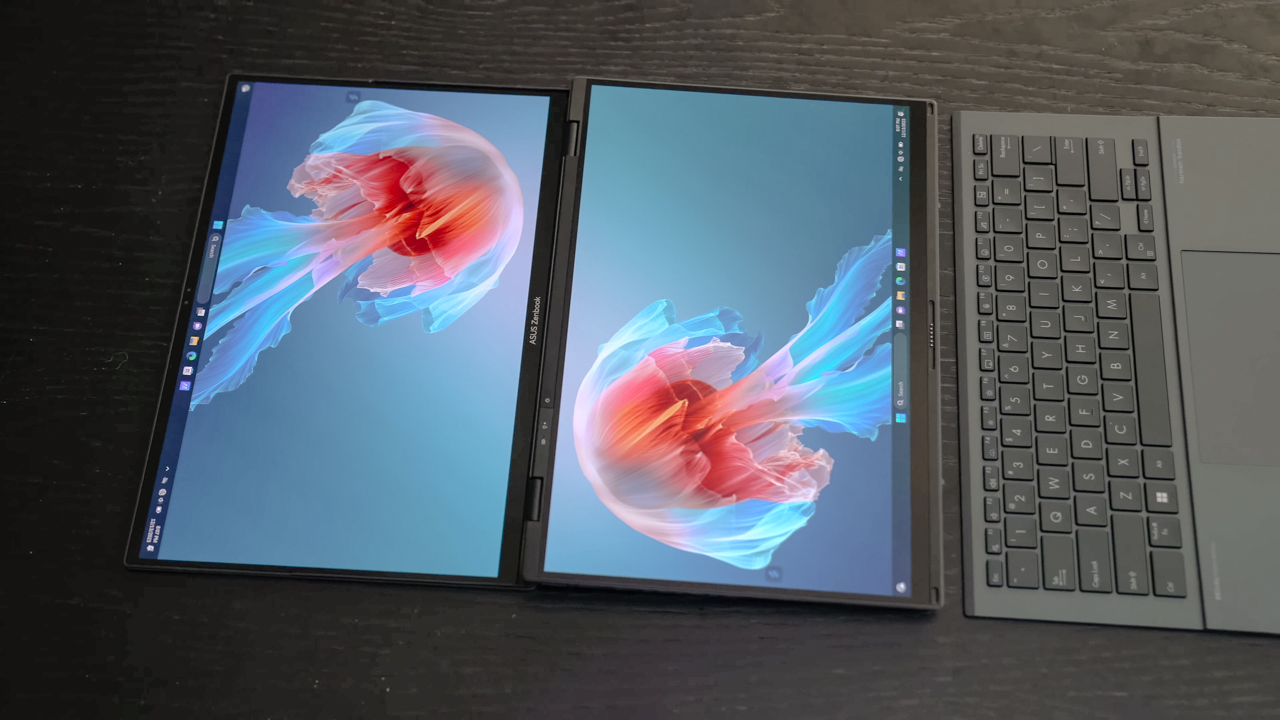

We are fans of what ASUS did with their latest dual screen offering — the ASUS Zenbook DUO 2024. The Zenbook Duo isn’t exactly new. ASUS has been adding extra screens to their laptops whenever they can — but never quite like this.

You see, ASUS managed to put a literal second display but still make it compact enough to fit most bags with provision for 14-inch laptops. As cliché as it sounds, the Zenbook DUO 2024 is an engineering marvel.

However, it’s more than just a gimmick. In our review, we noted how the form factor lent to a slight boost in productivity despite us not maximizing the product just yet. With that, let us share with you our favorite things about the ASUS Zenbook DUO 2024.

A unique mode for every scenario

A built-in, sturdy kick-stand unlocks the many possibilities available to the Zenbook DUO 2024. Some of the modes are: Laptop, Dual Screen, Desktop, and Sharing.

Each one lends itself nicely to different work and media consumption scenarios. Don’t feel like showing off? Keep things discreet and save some battery life with laptop mode.

Need two screens? Switch to either Dual Screen or Desktop mode to take advantage of more screen real estate.

Presenting something to someone across the table? Sharing mode lays the laptop flat allowing for easier viewing.

The ability to morph to different modes depending on your needs is astounding. The best thing is that it is both functional and can serve as an ice breaker.

Oh and we’ll never tire of sharing how the Desktop mode is perfect for watching two K-Pop fancams at the same time.

Screen Xpert for the dual displays

This form factor won’t work without the right software support backing it. To that end, ASUS made Screen Xpert. What it does is essentially let you adjust the layout of the apps according to your needs.

You can have up to four (4) apps live viewed at the same time. For our part, we usually only divided the screen to two, using one to reference a review guide or press release while writing news articles and/or reviews.

But if you’re monitoring certain things, this will be pretty helpful having multiple windows laid out right away to get a quick overview of things is a godsend.

The best thing is that a lot of these functions work intuitively. There’s a single button you can press to easily switch what’s displayed on the two screens.

If you want more granular control, you can have the Screen Xpert floating bar ready at your disposal. Here you can control the brightness level of each screen individually. You also have the ability to change the orientation of each screen to your liking.

There are also App Switcher and App Navigator functions to give you a better, more seamless way to layout the apps you use so that it’s most efficient for your needs.

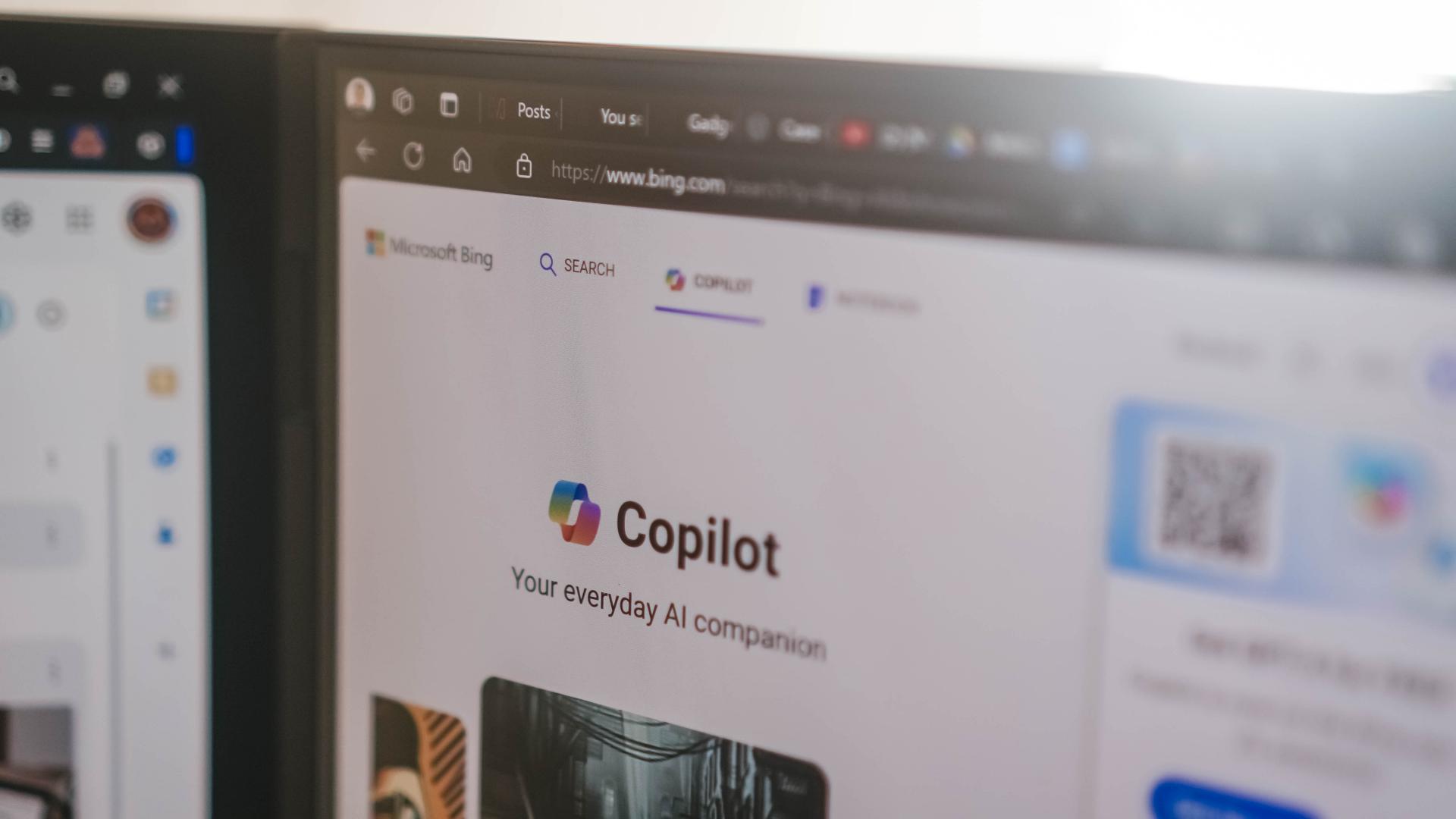

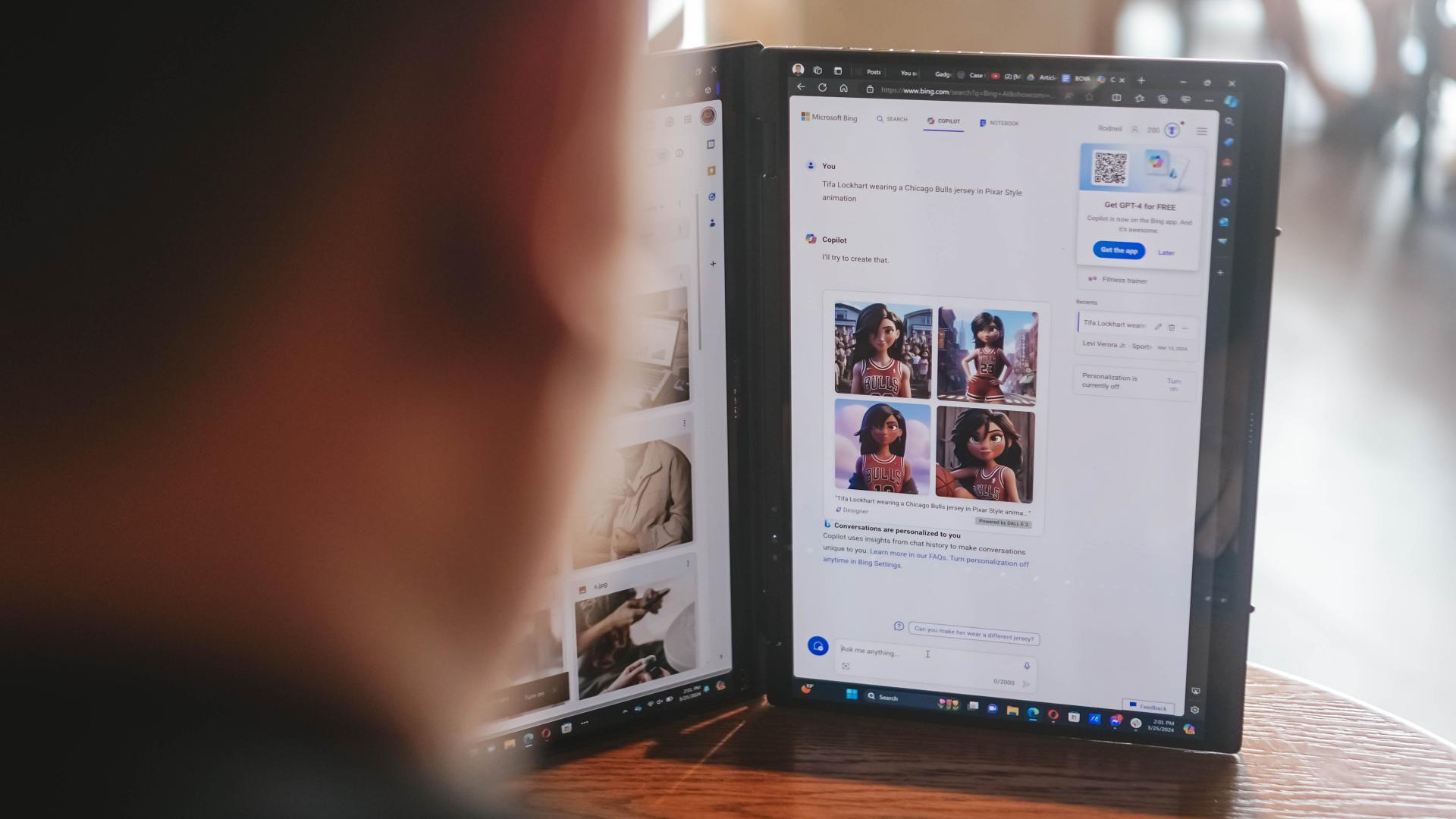

AI, Copilot, and more

Something we didn’t mention much in the review is how the laptop is built with the AI age in mind. Powered by Intel Core Ultra 7 155-H, this thing is equipped with an NPU chip to aid in on-device AI tasks.

There’s stuff that happens in the background like making sure the AI-related tasks are processed with the NPU while the main CPU handles the rest. In the simplest terms, the Intel Core Ultra 7 is smart enough to delegate a task to the chip that will best execute it. That results in a more optimized overall performance.

Copilot is one of the biggest AI additions to any Windows machine. The possibilities are close to limitless. For our part, we’ve only really played around with Copilot Designer. But there’s so much more that you can do with it. Just remember to always check the results. Every AI output still needs a human touch.

AI is also present in other functions like noise cancellation and the camera. AI Noise Cancellation makes sure you can hear and be heard no matter what scenario you’re in. It’s perfect for remote workers who do not exactly have control over their immediate surroundings.

Meanwhile, AiSense Camera works not only as a Full HD IR camera. It also automatically detects the lighting levels in your environment and adjusts brightness levels accordingly. You also get functions like auto-framing and background blur. Lastly, there’s the slightly creepy Eye Contact feature that locks your gaze to the camera. It can be a bit disorienting so maybe pick the occasions when you’ll use it.

GlideX

Working beyond this dual screen laptop? ASUS also made sure to equip the Zenbook DUO 2024 with software that makes adding even more screens a no-sweat task.

With GlideX you can easily connect your Zenbook DUO 2024 with smartphones, tablets, or even another PC. Even better, it’ll give you the option to control everything from a single device.

DUO more

For a first-of-its-kind device, the ASUS Zenbook DUO 2024 is pretty darn polished. That’s thanks largely to the company experimenting with dual screens long before releasing this dual screen machine.

The Zenbook DUO 2024 literally lets you do more, providing options for flexibility that will help you optimize your workflow so you can finish your tasks more efficiently. This is more than just a gimmick device, it’s actually helpful and that’s because ASUS took the time to fit it with the proper software support.

More on the ASUS Zenbook DUO 2024 here.

This feature is a collaboration between GadgetMatch and ASUS Philippines.

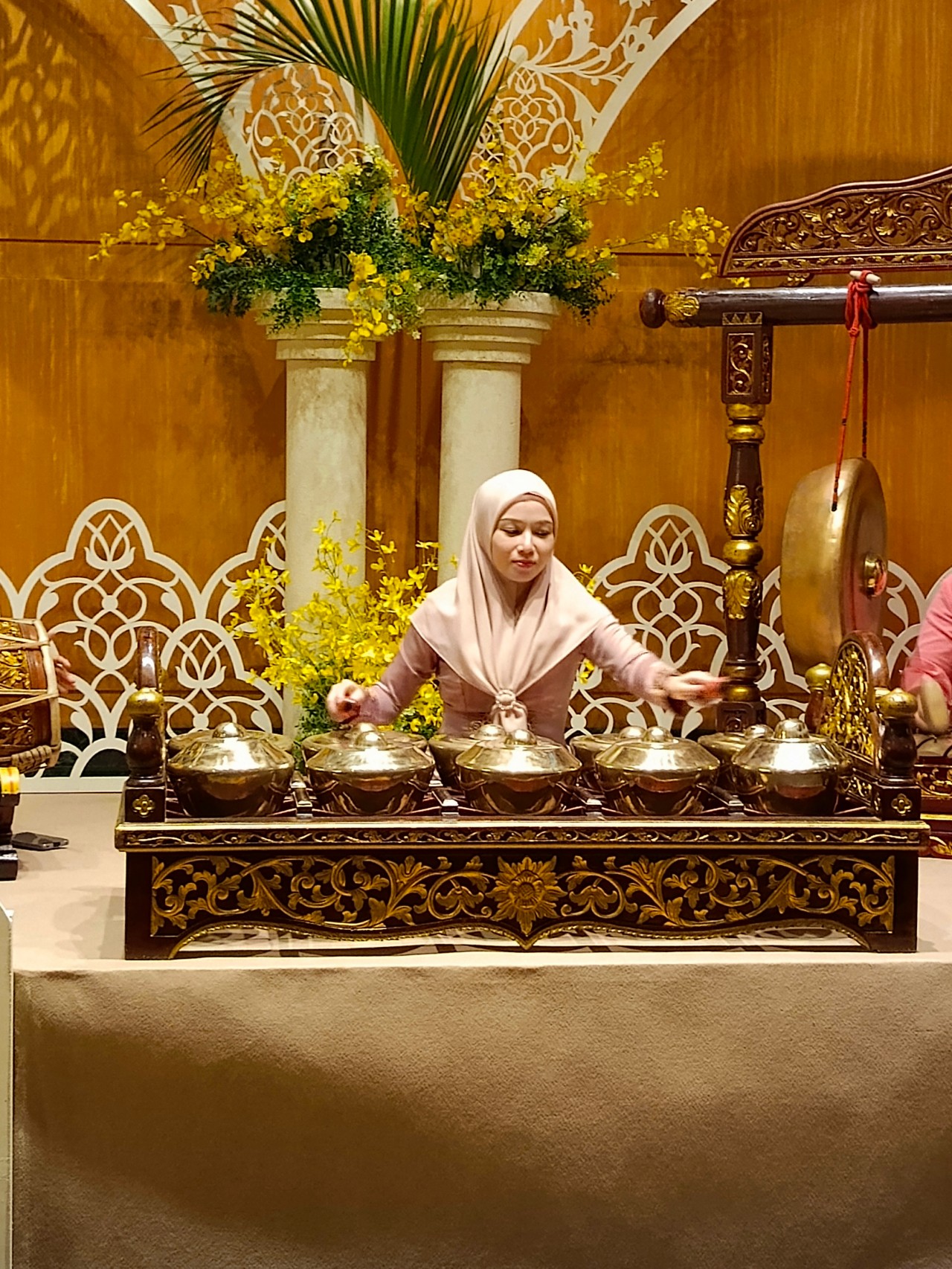

The Infinix Note 40 Pro+ 5G prides itself in its charging technologies. But what about its camera capabilities? Well, here’s a quick round-up of the many photos we took around the time the Note 40 series was launched in Kuala Lumpur Malaysia.

The NOTE 40 Series features a 108MP main shooter with 3x Lossless Superzoom. It also has OIS for steadier shots when taking videos.

The edits applied to the photos here only some resizing and cropping to make the page easier to load. Take a look at all these sample shots

Infinix Note 40 Pro series launch day

Kwai Chai Hong/ ‘Little Ghost Lane’

Petaling Street (Chinatown)

In and around Central Market

Bank Negara Malaysia Museum and Art Gallery

Istana Negara entrance

Merdeka Square

Malaysian Bak Kut Teh and more

Petronas Twin Towers at night

Steady shooter

The Infinix Note 40 Pro+ 5G isn’t a stellar shooter. But at its price point, it’s pretty darn decent for capturing different scenarios. Take these photos into some editing software and you can certainly elevate their look.

The NOTE 40 Pro+ 5G is priced at PhP 13,999. It may be purchased through Infinix’s Lazada, Shopee, and TikTok Shop platforms, where customers can get up to PhP 2,000 off. Additionally, the first 100 buyers can get an S1 smartwatch or XE23 earphones. Alternatively, customers may opt for the Shopee-exclusive NOTE 40 Pro (4G variant) for PhP 10,999.

-

Reviews7 days ago

Reviews7 days agorealme 12 5G review: It was enchanting to meet you

-

Buyer's Guide2 weeks ago

Buyer's Guide2 weeks ago2024 Samsung TV: Buyer’s Guide

-

Reviews2 weeks ago

Reviews2 weeks agoJBL Soundgear Sense review: Make every run magical

-

Reviews3 days ago

Reviews3 days agoOnePlus 12R review: Making sense of OnePlus’ latest flagship

-

Smartphones2 days ago

Smartphones2 days agoHuawei Pura 70 Pro Unboxing and First Impressions

-

Reviews2 weeks ago

Reviews2 weeks agoChallengers review: A thrilling drama wrapped as a tennis anime

-

News1 week ago

News1 week agoXiaomi Redmi A3 Philippine pricing, availability

-

Smartphones1 week ago

Smartphones1 week agoInfinix NOTE 40 Pro+ 5G: Philippine pricing, availability