Apps

Finally! Grab users may now pay directly using GCash

Much-awaited partnership

Grab Philippines and GCash have finally struck a partnership deal that will make payments on the superapp even easier and more convenient.

Starting February, users will be able to add GCash as a direct payment method on the Grab app, making cashless transactions on food and grocery deliveries, car transport, and other services cashless.

Prior to the collaboration, GCash users could only send money from their account to their GrabPay wallet, and vice-versa, causing a bit of hassle switching in between apps on one’s phone screen.

The partnership also means there will be no more transaction fees unlike before when Grab users have to cash in using their credit or debit cards or linked bank accounts.

Grab customers may also avail of GCash exclusive deals, and even get treats when they pay using the e-wallet.

Huawei will soon have its own painting app specifically designed for tablets: GoPaint. This makes the manufacturer the first to have its own self-developed painting app.

Huawei already teased its audiences with a short clip posted on its socials with the caption “Creation begins here.” GoPaint will go live on May 7.

The app will come with a wealth of brushes, and brings easy-to-use features for painting. The eventual launch of this app eliminates the need for beginners to download third-party apps, like ibis Paint X and Sketchbook.

With the integration of GoPaint along with Huawei’s capable hardware-software architecture, Huawei is pushing itself to be a creation go-to for tech users. Previously, the brand held a GoPaint Worldwide Creating Activity last year, which saw creators around the world participate.

The app will surely complement Huawei’s recent lineup of tablets which includes the MatePad 11.5 PaperMatte edition and the MatePad Pro 13.2.

The PaperMatte edition tablet eliminates glare and prevents reflection and fingerprints, replicating the feel of traditional paper. On the other hand, the MatePad Pro 13.2 offers users a smooth and seamless experience for creation, work, content consumption, and more.

The MatePad Pro 13.2 particularly features an OLED screen and works with Huawei’s 3rd gen M-Pencil for more than 10,000 pressure sensing levels. Both tablets support multi-device interconnection, remote PC access, and multi-screen collaboration.

Apps

Here’s why Grab Philippines is now focusing on dine-in too

A pivot to support consumers and partners’ needs

In a bid to strengthen its omnicommerce strategy, Grab Philippines is pivoting to an approach that sees the app put equal priority to both dine-in and food pick-up and delivery.

Although Grab’s food delivery arm GrabFood has been known throughout the years for its food pick-up and door-to-door services, Grab is working on also enhancing the dine-in experience. This aligns with Grab’s even bigger goal of meeting the needs of both consumers and MSME merchant partners.

So why dine-in “using” Grab?

As discussed during the GrabNext 2024 conference, Grab is pivoting to support the shift in consumer preferences, while integrating digital convenience to in-person dining. This move is largely due to the resurgence of dine-in culture after the pandemic.

Grab’s hybrid service model incorporates both physical presence and digital efficiency, so Grab’s restaurant partners can capitalize on the increased foot traffic.

Pay With Grab, Instant Deals

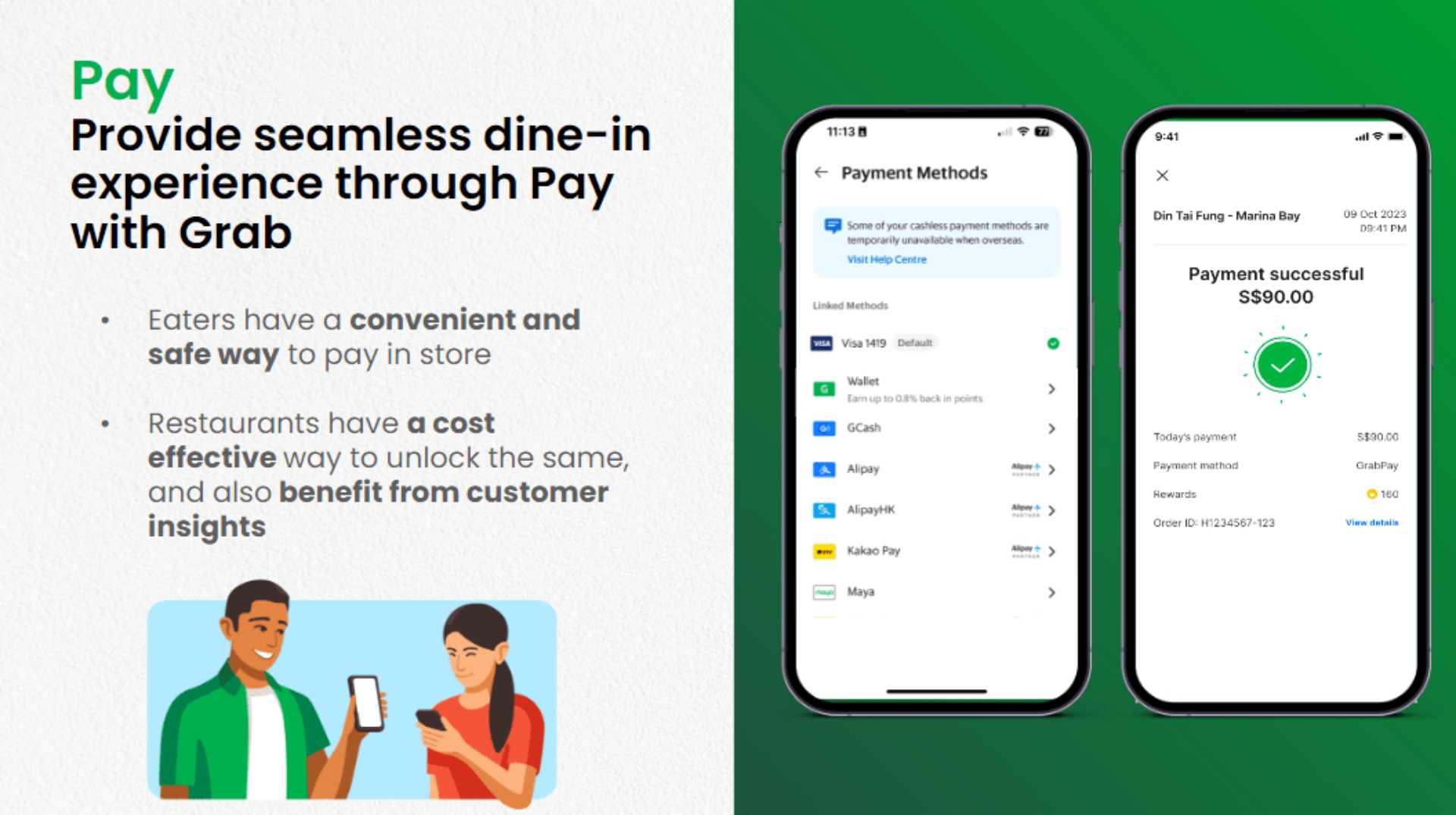

To cater to both diners and its MSME partners, Grab has rolled out two new services: Pay With Grab and Instant Deals.

Pay With Grab allows diners to pay using the Grab app for contactless transactions. They may connect bank accounts or other e-wallets that they already have used for Grab to complete the transaction.

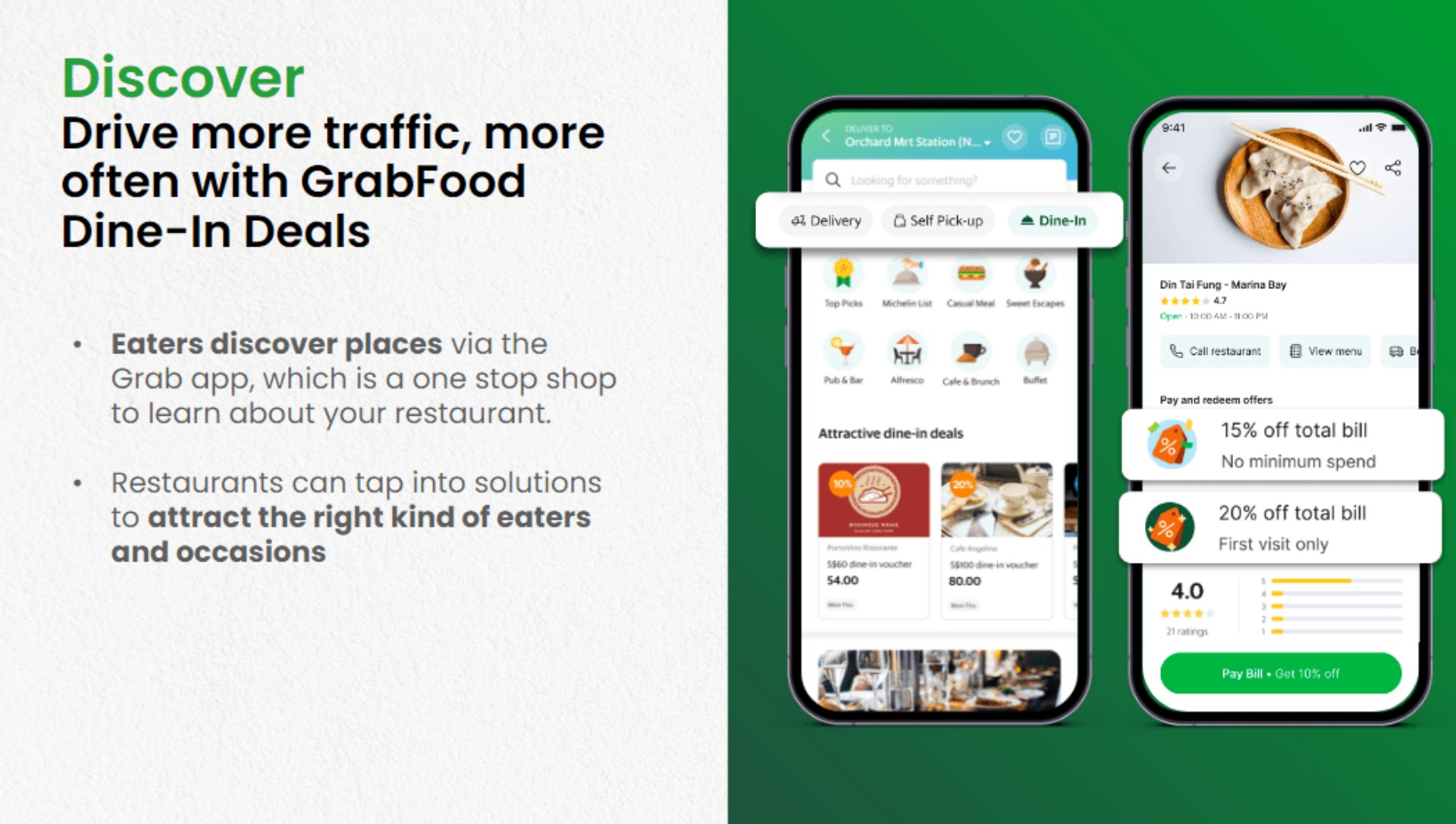

On the other hand, Instant Deals allows restaurants to offer customizable and timely promotions to attract more customers. These deals can be adjusted in real-time to reflect trends or even weather conditions. The deals will be shown on the restaurant’s GrabFood page.

How do I exactly dine-in with Grab?

Look at it this way: Grab is trying to have more consumers search for restaurants using the Grab app itself. Say for example you’re undecided where to eat or what to eat, Grab will help with that.

Oftentimes, Filipino diners ask out loud, “Saan puwede kumain (Where to eat)?” and “Saan ba masarap kumain (What’s a good place to eat at)?” With Grab’s new approach, they can simply open the app and see for themselves. If you end up finding an interesting restaurant that suites your cravings for that moment and also happens to have promos at the time, that’s a win for both you and the restaurant.

This is why Grab is incorporating particularly the Instant Deals service. As a return, their partner restaurants also benefit from more sales. After all, Grab isn’t the “all-in-one super app” for nothing.

Better support for MSMEs

Grab has also strengthened its support for MSME partners with enhanced omnicommerce that focuses on seamless integration.

First, Grab has unified the dine-in, pick-up, and delivery services into an easy-to-use platform for MSMEs to access. This tool supports inventory management, order tracking, and customer relationship management.

Moreover, MSMEs are provided with data-driven insights to better understand customer preferences, peak times sales patterns, and more. These advanced analytics will be useful for strategic decision-making on the restaurant’s part.

Grab also offers financial flexibility for its partners by offering access to GrabFin loans and faster settlement times.

Lastly, an Improved Marketing Manager tool empowers MSMEs to efficiently create and deploy marketing campaigns. This allows them to connect better with both digital and dine-in customers.

New users on X might soon face a tough time on the platform. The social media website will likely start charging new accounts a small fee for the right to post on the platform.

Now, the fee isn’t a new one. Almost six months ago, the company tested the paid system in New Zealand and the Philippines. New users in those countries had to pay a dollar per year for the ability to post and reply to content.

As spotted by X Daily News on the same platform, the company might be ready to take the experiment to a larger market. New text strings have shown that the policy is rolling out worldwide.

SPECULATION: X might be expanding its policy to charge new users before they reply/like/bookmark a post https://t.co/odqeyeiHBx pic.twitter.com/EU71qlwQ0D

— X Daily News (@xDaily) April 15, 2024

The policy is designed to combat a wave of bots appearing on the platform. By preventing new accounts from creating posts, X hopes to stave off the standard behavior of bots these days. You might have noticed them as OnlyFans creators in unrelated posts, peddling NSFW content on their bio.

Though the global rollout was only just spotted, owner Elon Musk has seemingly confirmed the change. Replying to X Daily News, Musk says that it is “the only way to curb the relentless onslaught of bots.” He says that the current breed of bots can easily bypass simple checks these days.

-

Reviews1 week ago

Reviews1 week agorealme 12 5G review: It was enchanting to meet you

-

Buyer's Guide2 weeks ago

Buyer's Guide2 weeks ago2024 Samsung TV: Buyer’s Guide

-

Reviews3 days ago

Reviews3 days agoOnePlus 12R review: Making sense of OnePlus’ latest flagship

-

Reviews2 weeks ago

Reviews2 weeks agoJBL Soundgear Sense review: Make every run magical

-

Smartphones2 days ago

Smartphones2 days agoHuawei Pura 70 Pro Unboxing and First Impressions

-

Reviews2 weeks ago

Reviews2 weeks agoChallengers review: A thrilling drama wrapped as a tennis anime

-

News1 week ago

News1 week agoXiaomi Redmi A3 Philippine pricing, availability

-

Smartphones1 week ago

Smartphones1 week agoInfinix NOTE 40 Pro+ 5G: Philippine pricing, availability