Most of us rely on our apps to connect, work, and move. Switching between apps, doing work, messaging people — everything can be done in a single tap. I’d be lying if I said apps didn’t help improve my life. It offered me convenience, and as a young 20-something in the midst of his blossoming career, apps made me more efficient and productive.

When I attended Social Media Week in Manila, I was reminded of how my life depended on my apps. The event tackled how apps are changing our lifestyle, behavior, and culture — it might even be bringing the worst in us.

As a young adult filled with hope, I believe apps bring the best in us — not the worst. The only time apps will make a negative impact in our lives is when you abuse it. Always, always use it sparingly. Believing that apps aren’t inherently bad, here are apps that definitely make any young adult’s life easier.

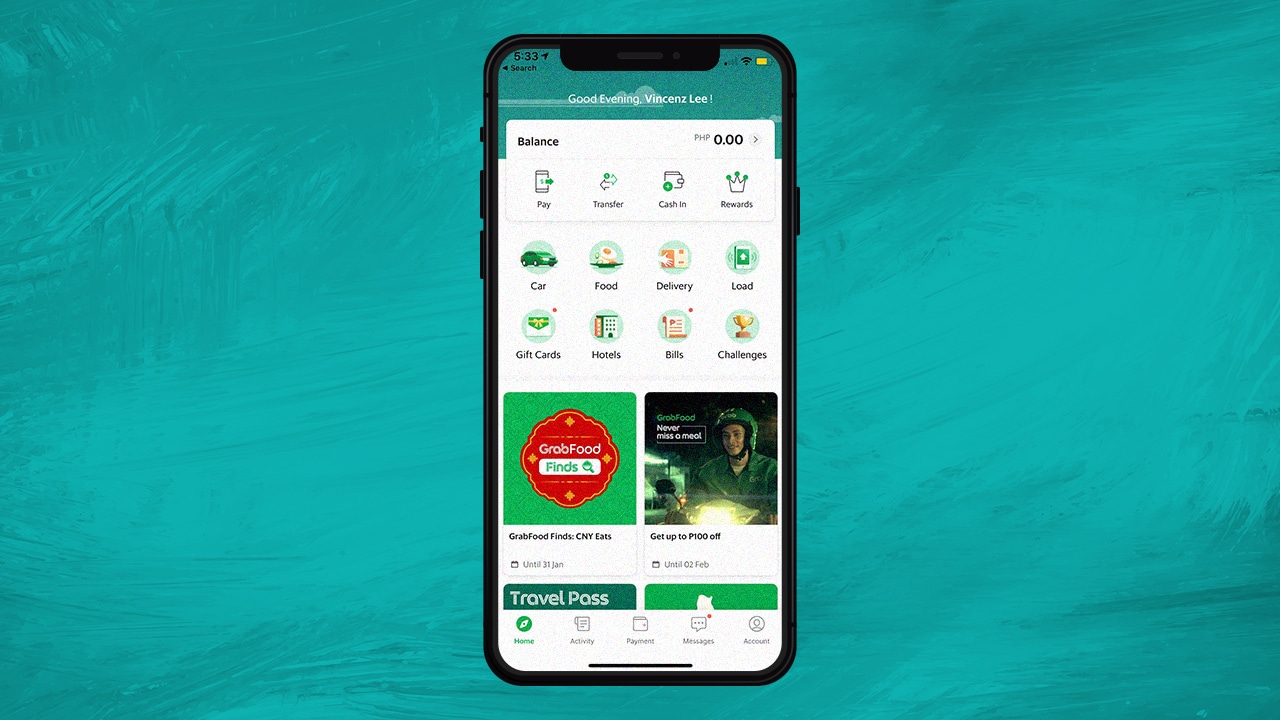

Grab

After Uber left my country, Grab took over. While I hate monopoly, Grab made itself indispensable, hosting a full suite of services that everyone would badly need in the worsening living condition in the metro. From taxis, private cars, to express shipping, and even food deliveries — Grab ingrained itself in our lives, it’s going to make you wonder: “What was life before Grab?”

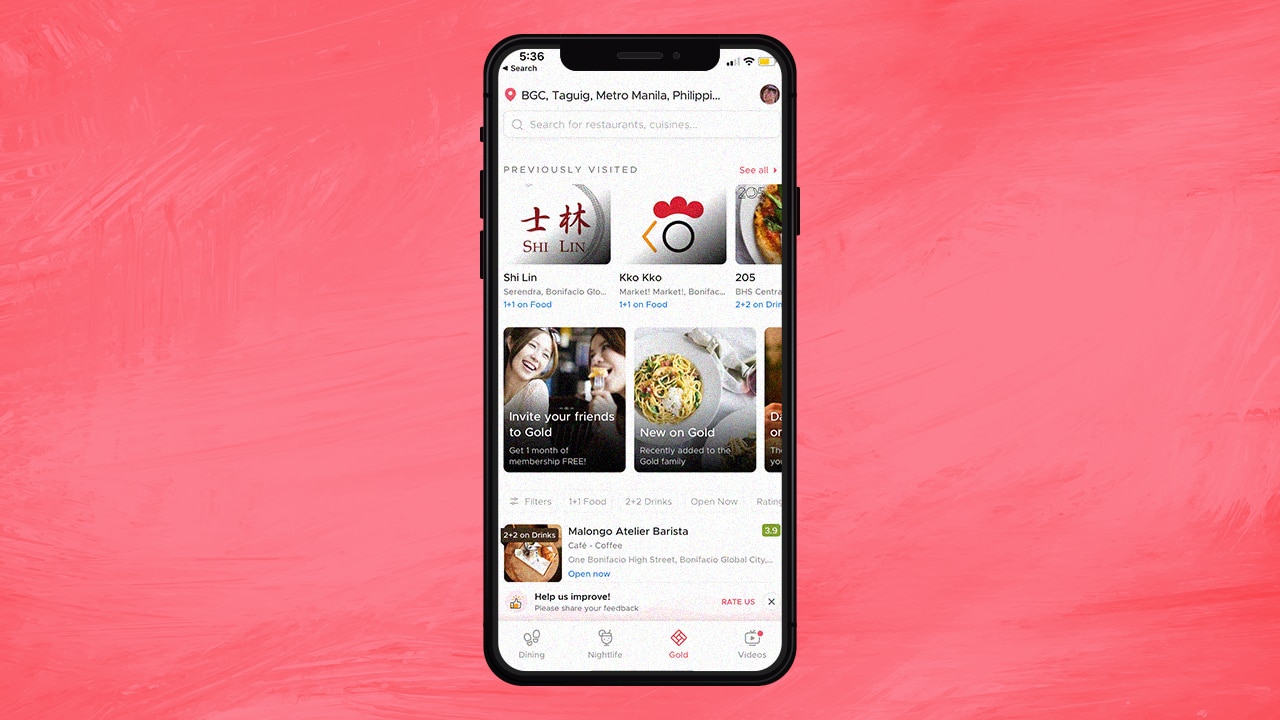

Zomato

As an urban dwelling young adult, Zomato has been essential for my date nights. It suggests restaurants and cafes which would make my life easier when deciding for a place to eat with my beau. Hangouts and catch up with friends are also easier, with their 1+1 or 2+2 promo, allowing us to eat at our heart’s content without spending too much.

If there’s one thing that you should have on your smartphone, it’s Google’s mobile apps. It has everything you need — Chrome, Search, GMail, Maps, Drive, Calendar, Contacts, you name it! Work and life would be a lot easier if you have these. Trust me.

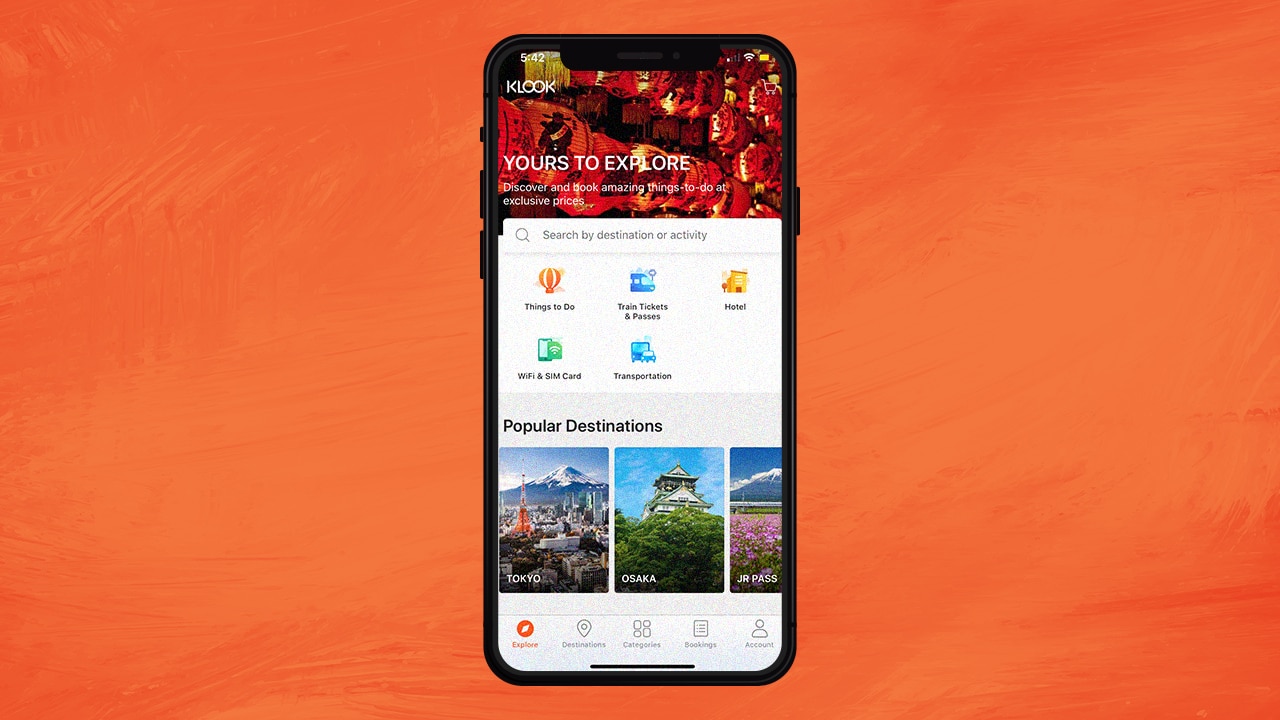

Klook

Traveling has been one of every young adult’s goals they hope to achieve before turning 30. In case you didn’t know, travel is eighty percent planning. As a frequent traveler, Klook made my trips easier, allowing me to buy mobile sim cards, book a tour, and get discounts even before I arrive at my destination. Klook, in a sense, can save you time, money, and headaches so you can focus on the adventure waiting for you.

YouTube

There’s more to YouTube than vlogs and music videos. If you use YouTube right, you can get tips on how to achieve your fitness dreams, some DIY crafts to keep you occupied, styling tips, gadget reviews, and more. By now, you already know that learning doesn’t stop at school. If you want to commit to self-development, YouTube can be your university — hosting courses that appeal to your interests.

Instagram/TikTok

Just like YouTube, Instagram is more than just aesthetically-pleasing photos and TikTok is more than just a collection of wacky, senseless short videos. Both apps are changing the way we consume content, with young adults using Instagram and its Stories feature more to connect and update with friends and the people they admire. Tiktok, on the other hand, is becoming a platform for the younger generation. Nonetheless, both Instagram and TikTok can provide inspiration and laughter — if you scour and follow the right accounts.

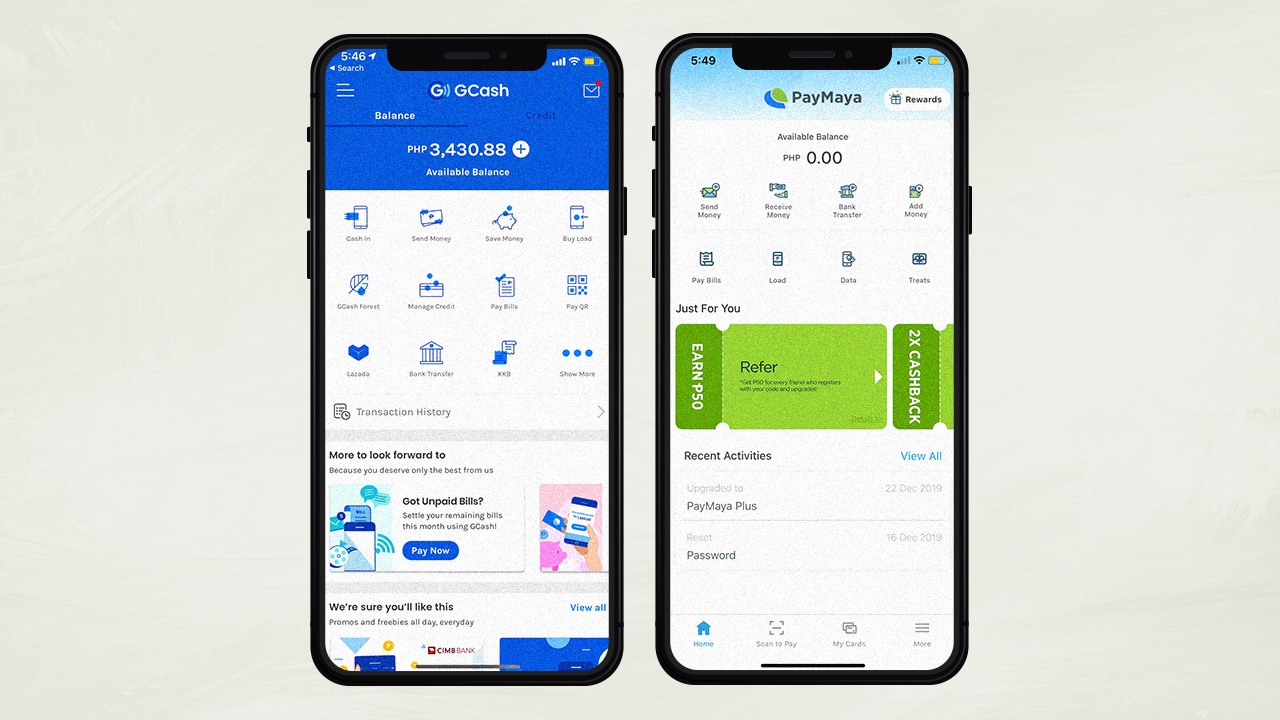

GCash/PayMaya

Banks might be leaning towards apps for accessibility and convenience, but GCash and PayMaya revolutionize the way we handle our finances. Through these apps, we can transfer charge-free between banks albeit it’s a tedious process. On the other hand, you can use both GCash and PayMaya to pay your bills, load your prepaid cards, and send money — while getting rebates for using their services.

Bonus: Angkas

I can’t recall how many times Angkas saved my life. When I woke up late for a meeting and I braved the horrible traffic jams to make it, Angkas was always there. The future of motorcycle taxi in the Philippines is still blurry, but every young professional must have this app to get through the metro. Don’t worry about the cost, though. You can always make money, but you can’t get back the time wasted stuck in traffic. Make the most of your youth!

Apps

Live NBA action on Disney Plus now available in the Philippines

Stream the live action starting November 20th

The NBA will now stream live on Disney+ as well for Filipino fans as part of a multi-year agreement.

This marks an expansion of Disney and ESPN’s global relationship with the NBA, bringing live coverage to the streaming platform for the first time.

ESPN, of course, is owned by The Walt Disney Company and is one of the latter’s major divisions.

Under the agreement, fans in the Philippines will get closer to courtside action with special access to live NBA games. There’s also ESPN’s award-winning documentaries and live broadcasts of NBA Countdown too.

Moreover, fans can tune in to legendary voices Shaquille O’Neal, Ernie Johnson, Kenny Smith, and Charles Barkley in real-time with NBA Tip-Off and Inside the NBA.

NBA on Disney+ will officially start on Thursday, November 20 morning (November 19 in the United States) with a double-header featuring these match-ups:

- Houston Rockets at Cleveland Cavaliers (8:00 A.M.)

- New York Knicks at Dallas Mavericks (10:30 A.M.)

Disney+ subscribers will be able to live stream select regular season and playoff games, including marquee events like NBA on Christmas Day, NBA Draft, the NBA All-Star Celebrity Game, and select Summer League Games.

The agreement also includes one NBA Conference Finals series live. Another Conference Finals series and the NBA Finals will both be available to stream on delay as well.

Apps

Don’t get tricked: Spot these financial monsters before they get you

Ghosts are harmless compared to these real-life threats that prey on your hard-earned money.

The spooky season has arrived, but not all monsters wear masks. Some hide behind fake links and shady offers designed to trick you into giving up your hard-earned money.

These are the real-life financial monsters: fraudsters, impersonators, and manipulators who turn everyday moments into horror stories.

According to the Cybercrime Investigation and Coordinating Center, 32% of Filipinos have fallen victim to digital fraud in the past year. And while it’s tempting to think you’d never fall for one, scammers are getting smarter and more creative.

Here’s what to watch out for:

Suspicious links and emails.

Those random texts and emails saying “there’s a problem with your account” or “you’ve won a prize”? They’re classic traps.

Scammers disguise themselves as legitimate companies to steal your information or access your accounts. Always double-check the sender’s address. If it looks off, don’t click.

Grammar gone wrong.

If a message is full of weird typos, awkward phrasing, or off punctuation, that’s a red flag.

Reputable companies review every message they send. When in doubt, don’t reply. Report it to authorities like the PNP Anti-Cybercrime Group or the NBI.

Urgent and emotional messages.

Scammers love to pressure you. They’ll make you feel scared or guilty to get you to act fast.

Real companies won’t threaten or rush you into sharing personal info. Take a breath, hang up, and reach out to the official hotline to verify.

Deals that sound too good to be true.

If someone promises instant money or massive discounts, run. These scams often demand “processing fees” or personal info before disappearing. No legitimate prize will ever require payment upfront.

Behind every scam is a story of someone who deserved better. Sometimes, what started as a simple loan application can turn into a nightmare if a rogue online lender decides to harass someone over payments they didn’t even fully receive.

It’s a familiar story for many Filipinos who’ve been preyed on by unregistered or unethical financial services.

Thankfully, more responsible lenders and financial platforms today (Tala, for example) are working to raise awareness and fight back against these threats.

Some even use advanced systems to flag suspicious behavior, partner with authorities for investigations, and educate communities through financial literacy programs.

At the end of the day, awareness is your strongest defense. So this Halloween, stay sharp because protecting your peace (and your money) will always be the sweetest treat.

It’s nothing new that most productivity subscriptions these days are forcing AI onto their subscribers to justify higher prices. Microsoft, for example, now bundles its Microsoft 365 subscriptions with Copilot and other AI-powered features. However, most users don’t really need or want these features. Apparently, the company recognizes this and offers a cheaper subscription without Copilot. It’s been hidden though, and now Microsoft is in trouble for keeping it hidden.

A few days ago, the Australian Competition and Consumer Commission (ACCC) is suing Microsoft foMicrosoft is ending support for Windows 10r allegedly hiding a cheaper subscription tier and effectively forcing users into a pricier tier (via Reuters). In the country, the price of an individual annual subscription rose by 45 percent.

Currently, the regular tier, dubbed Microsoft 365, packs in access to Microsoft Office, 1TB of OneDrive storage, and Copilot. The allegedly hidden tier contains everything above except Copilot. The Australian organization claims that the company did not clearly tell users about the cheaper subscription.

As a result, the ACCC wants Microsoft to pay around AUD 50 million per breach of the country’s consumer laws. The court is still investigating the ACCC’s claims.

How to access the cheaper subscription

Though the lawsuit is in Australia, the subscription is hidden for most users around the world. Because of how difficult it is to access, the ACCC does have a substantial claim that the company is intentionally hiding the tier. Here’s how to access it:

The tier, officially called Microsoft 365 Personal Classic (or Family Classic), isn’t available if you just go through Microsoft’s list of subscriptions. Currently (and as far as we can tell), you need to attempt to cancel your ongoing subscription. Only after then will Microsoft offer you the cheaper subscription without Copilot or any AI features.

According to Microsoft’s website, the cost of a regular subscription costs PhP 4,899 per year (or PhP 489 per month). In comparison, the cost of the Classic subscription costs only PhP 3,499 per year, which is what the regular subscription used to cost per year.

Is there a risk with going Classic?

Switching to the Classic subscription naturally begs the question: What happens when you go for a subscription that Microsoft desperately wants to hide?

Nothing, really.

If you don’t need Copilot, the Classic subscription saves you from paying for an unnecessary feature. Even if you can just turn off Copilot on a regular subscription, you’re still paying for it.

That said, Microsoft does say that there is a risk. The Classic subscription is just a “limited” option, meaning that there is a chance that the company will stop offering the tier for users.

Currently, Microsoft has not said anything about when (or if) this is happening. It’s also possible that the company might just gatekeep some upcoming features from Classic.

For now, Microsoft 365 Classic remains the only way to keep the subscription price low.

-

Laptops2 weeks ago

Laptops2 weeks agoSpotlight: ASUS ProArt P16

-

News2 weeks ago

News2 weeks agoThe Mate 70 Air is HUAWEI’s clapback to the iPhone Air

-

Gaming2 weeks ago

Gaming2 weeks agoThe Nintendo Switch is nearing the end of its lifecycle

-

Deals2 weeks ago

Deals2 weeks ago11.11 sale top picks: Phones, tablets, appliances, gaming gear, more

-

Cameras2 weeks ago

Cameras2 weeks agoCanon announces EOS R6 Mark III camera, RF45mm f/1.2 STM lens

-

Cameras1 week ago

Cameras1 week agoI thought the Insta360 X4 Air would be easy

-

Gaming2 weeks ago

Gaming2 weeks agoGrand Theft Auto VI delayed to November 2026

-

Deals2 weeks ago

Deals2 weeks agoGet a chance to win an iPhone 17 Pro with the ECOVACS 11.11 sale