Apps

ChatGPT will soon allow NSFW conversations

The platform will start age-gating users in December.

Every day, we inch closer and closer to the strange reality of Joaquin Phoenix’s Her. Today’s AI-powered chatbots have inevitably adapted to address our more carnal desires. Some, such as those offered by xAI, are even explicitly designed to only flirt with the user. Soon, ChatGPT will offer the same thing: a way for adult users to… well, be adults.

Through a post on X, OpenAI’s Sam Altman reiterated ChatGPT’s impending drive to introduce age-gating in December. Keeping younger users from the platform will open ChatGPT to more “mature” conversations. Altman specifically names “erotica” as one of the potential uses of a looser platform.

We made ChatGPT pretty restrictive to make sure we were being careful with mental health issues. We realize this made it less useful/enjoyable to many users who had no mental health problems, but given the seriousness of the issue we wanted to get this right.

Now that we have…

— Sam Altman (@sama) October 14, 2025

Additionally, ChatGPT is rolling out an update which will make the platform more personable and comparable to actual conversations. This includes using more emojis or talking like a friend.

The platform is also adding more safeguards when it comes to mental health issues, given that more people are using it as a makeshift therapist. Recently, Altman made sure that ChatGPT treated mental health with more delicateness. To some, especially those without such issues, the platform became more unusable. To bring back how it used to be, the platform will add better tools to detect whether the user is in “mental distress.”

Finally, OpenAI is implementing a backend solution to mental health by creating a new council of researchers and experts to accurately determine the impact of AI on mental health. Currently, it’s still unknown how much this new technology is helping (or harming) our wellbeing.

SEE ALSO: ChatGPT Go now available in the Philippines, more Asian countries

Apps

Breaking up with Adobe Photoshop after 20 years

Wedding planning and Apple Creator Studio made me realize it was time

Planning a wedding, even a small and intimate one, has a way of sharpening your sense of priorities. Right as my fiancé and I were making decisions for our city hall wedding here in New York City, Apple announced Creator Studio.

Creator Studio is a subscription service that gets you access to eight creative pro and productivity apps for US$12.99 a month, or US$2.99 if you’re a student or educator. The design app included in the subscription, Pixelmator Pro, is also available as a standalone purchase for US$49.99. Adobe Photoshop, my design software of choice for over two decades costs me US$22.99 a month.

Seeing those numbers next to each other made me pause. It’s not that I was unhappy with Photoshop. I was just suddenly made aware how expensive it is. I’d been paying more for a single tool than I could for an entire creative ecosystem.

Creative Studio’s lower price point, along with the free trial, made me consider switching to Pixelmator Pro altogether. That’s something I never thought I would do. Photoshop was how I got into graphic design. It was my first love, and up until recently, I truly thought it would be my ride or die.

Getting to know Pixelmator Pro

If you’re not familiar, Apple’s Pixelmator Pro is a graphic design and image editing app that’s similar to Adobe Photoshop. In practice, it covers a huge amount of the same ground but with a very different philosophy around usability and design.

I tried Pixelmator Pro, mostly as a challenge because we were doing a YouTube video on Apple Creator Studio. Personally, I was lowkey excited to try something new.

The first time I loaded the app, I recreated our YouTube thumbnail template — all within 10 minutes — and I haven’t looked back since.

Familiar enough to feel effortless

One of the biggest reasons my transition to Pixelmator Pro was so easy is muscle memory. Many shortcuts behave the same way: cmd+T for transform, cmd+R to show rulers, cmd+J to duplicate layers, just to name a few.

Having used Photoshop since high school, it felt familiar and intuitive — the complete opposite of how it felt to try and switch to Adobe Illustrator many years ago.

Photoshop is how I got into graphic design. It was my first love, and up until recently, I truly thought it would be my ride or die.

Later, I learned that you can import PSD (Photoshop) files directly to Pixelmator Pro. Apparently I didn’t even need to recreate the GadgetMatch assets. It does a good job of converting and preserving layers.

Photoshop now feels archaic

After using Pixelmator Pro for a few days, going back to Photoshop felt jarring. The sharp edges of the UI felt cold and rigid. Everything was layered with popups, panels, and tiny interruptions.

Pixelmator Pro, in comparison feels warm, smooth and frictionless. Its user interface is very Apple-like — rounded edges, softer icons and buttons. The Creator Studio version also gets the new Liquid Design touch, with transparent menus and elements that feel dynamic.

I especially love the little things. Color adjustments live in one simple panel instead of being scattered across different windows. There’s an eyedropper tool beside every color picker with a magnifier built-in.

When you hover over tools, it shows you the shortcut (e.g. “R” for Repair). There are also subtle animations, like when you use the Color Fill tool to change your canvas color.

The differences in user experience are stark. Photoshop’s animations either don’t exist or are too abrupt for one to notice.

Smart tools without the noise

Photoshop has one clear advantage over Pixelmator Pro: Generative AI. It’s great and powerful especially when you need to save time.

I personally used it a couple of times before to save time on cloning, erasing, or expanding elements. Am I going to miss it with this switch? Something tells me I won’t.

Pixelmator Pro’s clone and repair tools, though seemingly so simple, work like a charm. And for how I usually manipulate images, those two are more than enough.

From digital to physical

If Pixelmator Pro was going to replace Photoshop in my workflow, wedding prep was the perfect time to give it a real world test — and it more than held its own. Its ease of use gave me permission to think outside the box, because I knew I had a reliable tool that can help me make it happen.

On the left, a Kufic-inspired wedding logo designed on Pixelmator Pro; on the right, 3D printed stamps

Since my fiancé is half-Iranian, I designed a logo combining our names, inspired by Kufic calligraphy, and I did it entirely in Pixelmator Pro. I developed that same logo further and designed a save the date, with color, also inspired by Kufic calligraphy. I went through a few iterations to come up with the final designs, which were made easier by the Shape tool and grid overlays.

My fiancé then took the logo I designed in Pixelmator Pro, converted it to 3D on Revit, and printed it into stamps in different sizes. One way we’re using it is to deboss the handmade pottery he’s making as one of our party favors.

There are a few more wedding pieces I’m designing on Pixelmator Pro in the coming weeks: our final invitation, and the custom stationery for the dinner that follows the ceremony.

Through this whole process, Pixelmator Pro never felt like it got in the way, or that it was limited. On the contrary, it feels like that enabler friend who says yes to every idea I have, and can actually help make them real.

Powerful, but approachable

The best way I can describe what using Pixelmator Pro is like is this: it’s a mix of Photoshop’s professional tools, Canva’s free library of assets, and Apple’s UI sensibility.

Shortly after Apple announced Creator Studio, Adobe rolled out significant Creative Cloud discounts. Are they threatened? They better be.

That makes it great for beginners, small business owners, and casual creators. Like Canva, it comes with some beautiful templates to help someone with zero experience come up with something good.

But unlike Canva, it still feels like a serious design tool. I can do so much of what I need using Pixelmator Pro but with UI that’s so much more approachable compared to Photoshop.

I remember meeting Canva’s founders before launch and not fully understanding their mission to make graphic design accessible to everyone. Now I do.

It was never about replacing Adobe products and pro designers. What Canva did was fill a huge void we didn’t know existed. They democratized something that used to be reserved only for the privileged few.

Pixelmator Pro comes with free templates, assets, and mockups like this MacBook Pro and coffee packaging

Pixelmator Pro’s lower barrier to entry has potential to make a significant impact. My hope is it opens doors for people who were previously shut out of the graphic design world, and that it becomes something they can grow with, just as I did with Photoshop.

Adobe is still the industry standard

Switching to Pixelmator Pro wasn’t about rejecting Adobe, in the same way that Canva’s success did not kill Photoshop.

It’s worth noting that Adobe products are still the standard in the industry. A lot of companies rely on them, and most schools teach them. In a traditional design or agency environment, Photoshop and Illustrator are still the default language.

Even on Apple’s own Design Resources site for developers, the official design templates are built for Adobe Photoshop and Illustrator, not Pixelmator Pro. That says a lot about how embedded Adobe is in professional workflows.

Competition makes the space better

Apple Creator Studio, and tools like Pixelmator Pro, challenge Adobe’s near-monopoly in a really healthy way.

It’s not lost on me that trading Photoshop with Apple software actually keeps me locked into one ecosystem. But having more pro creatives try Pixelmator Pro can put pressure on the industry. A strong alternative that’s more cost effective can force titans and dinosaurs to evolve in a way the likes of Corel was never able to do.

Ideally, that means better products and fairer pricing for everyone. Shortly after Apple announced Creator Studio, Adobe rolled out significant Creative Cloud discounts. Are they threatened? They better be.

Access matters, and at the end of the day, with a healthy competition in the market, it’s consumers that win. Canva is a great example of this. It made design tools accessible to those who aren’t professionals. It didn’t make everyone a great designer, just as a novice who tries Final Cut Pro today won’t become a pro video editor tomorrow. Design is still a craft you develop over time with practice.

Is Pixelmator Pro my GadgetMatch?

Photoshop still has its place. But for my everyday work, and occasional personal projects, Pixelmator Pro can do everything that I need to accomplish, at a fraction of the cost.

It feels faster, lighter, and more alive. Honestly learning my way around new software has been so enjoyable — so much so that I feel a renewed sense of eagerness to try other design software like Blender and Figma.

Pixelmator Pro never felt like it got in the way, or that it was limited. On the contrary, it feels like that enabler friend who says yes to every idea I have, and can actually help make them real.

Wedding planning and Apple Creator Studio didn’t just make me switch to a new software. They also made me question how much I’ve been missing out on. How much of what I do is simply due to inertia?

Ending my longest relationship doesn’t mean it failed. I’m grateful for what Photoshop taught me. It helped shape the creative professional that I am today.

But alas, this is one area where my practicality wins over loyalty. Relationships — with people or with tools — only work when both parties keep showing up. There’s no room for complacency, despite the history.

Walking away from something that taught me so much feels bittersweet, but Pixelmator Pro fits the way I work now, and I hope it grows with me as I turn the next page.

Apps

Apple Creator Studio: Creative apps bundled into single subscription

All the tools you need, one payment

Apple has officially streamlined its popular creative apps into one single subscription suite with the introduction of Apple Creator Studio.

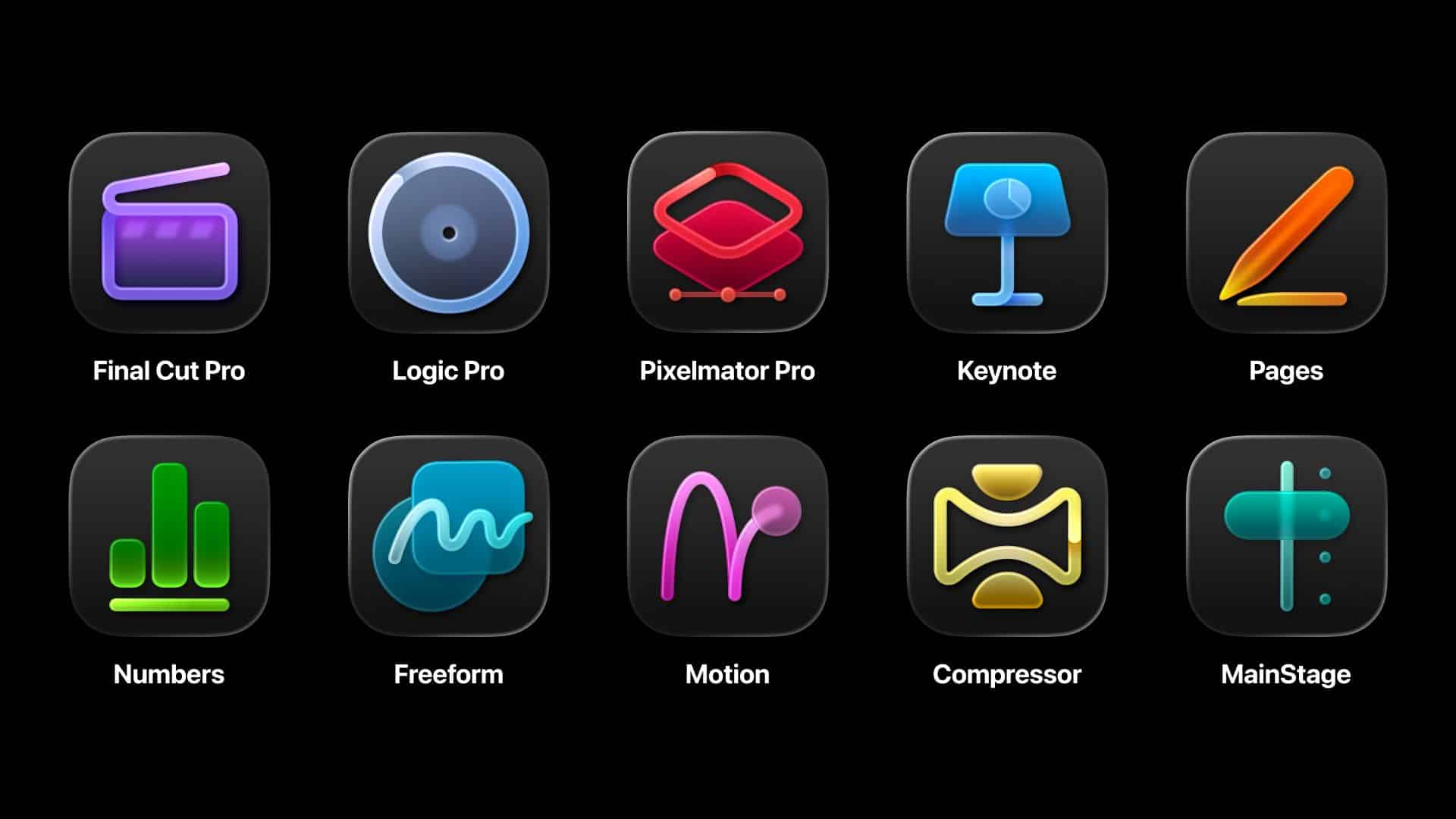

The collection includes some of the most useful apps for today’s creators: Final Cut Pro, Logic Pro, Pixelmator Pro, Motion, Compressor, and MainStage.

New AI features and premium content in Keynote, Pages, and Numbers also make the Apple Creator Studio an exciting subscription suite. Freeform will eventually be added to the lineup.

The groundbreaking collection is designed to put studio-grade power into the hands of everyone. It builds on the essential role Apple devices play in the lives of millions of creators worldwide.

The apps included cover video editing, music making, creative imaging, and visual productivity to give modern creators the features and capabilities they need.

Final Cut Pro introduces exceptional new video editing tools and intelligent features for Mac and iPad.

For the first time, Pixelmator Pro is also coming to iPad with a uniquely crafted experience optimized for touch and Apple Pencil.

Logic Pro, meanwhile, for Mac and iPad introduces more intelligent features like Synth Player and Chord ID.

Apple Creator Studio will be available on the App Store beginning January 29. In the Philippines, the rates are PhP 399 a month or PhP 3,990 annually.

There is also a free one-month trial which includes access to:

- Final Cut Pro, Logic Pro, and Pixelmator Pro on Mac and iPad

- Motion, Compressor, and MainStage on Mac

- Intelligent features and premium content for Keynote, Pages, Numbers, and later Freeform for iPhone, iPad, and Mac

College students and educators can subscribe for a discounted price of PhP 149 per month or PhP 1,490 per year.

Apps

Apple gives up on making AI, inks a deal with Gemini to power Siri

Gemini gets another feather in its cap.

In the not-too-long-ago past, the biggest names of the tech industry competed to build their own AI software. Now, though some brands are still on the hunt, it’s easier to name certain software that have more successfully drowned users in a flood of AI-powered features. Today, Google gets another win by adding Apple’s Siri to its Gemini cap.

In the past, Apple peddled Apple Intelligence, an upcoming AI-powered system to compete against the giants of the industry. However, much like other features from other brands, Apple Intelligence came out half baked with features still lacking months after the initial launch.

Now, Apple has signed a deal with Google to use Gemini for a revamped Siri. The former plans to launch a new version of Siri later this year. Because of the deal, the voice assistant will start using Gemini as a foundation for its own services. Currently, Samsung’s Galaxy AI already uses Gemini.

Formerly a battleground between so many competing brands, it’s now looking like a battle between two major companies: Google and OpenAI. Google now has a huge grip, though. Both Samsung and Apple are no slouches when it comes to owning market share in the world’s smartphones.

Now, as consumers, Apple’s deal probably doesn’t mean much besides the continued influx of features that add little to no value to a smartphone.

SEE ALSO: Google paid Samsung a lot of money to install Gemini on Galaxy

-

News2 weeks ago

News2 weeks agoInfinix NOTE Edge debuts: High-end features for accessible pricing

-

Reviews1 week ago

Reviews1 week agoHONOR X9d 5G review: Tougher, more long-lasting and optimized

-

Automotive2 weeks ago

Automotive2 weeks agoBYD expands PH presence with entry of DENZA luxury EVs

-

Gaming1 week ago

Gaming1 week agoNow playing: Final Fantasy VII Remake INTERGRADE on Switch 2

-

News2 weeks ago

News2 weeks agoHONOR slaps the iPhone Air with the all-new Magic8 Pro Air

-

Accessories1 week ago

Accessories1 week agoRazer fully unwraps these limited BLACKPINK Edition gaming gear

-

News2 weeks ago

News2 weeks agoBeyond the Box, Digital Walker turn over Tesla Model Y to iPhone 17 raffle winner

-

Gaming1 week ago

Gaming1 week agoForza Horizon 6 launches on May 19