Finance

GoTyme Bank now official; brings financial solutions for Filipinos

GoTyme Bank, a modern digital bank from Gokongwei Group in partnership with the Singapore-based Tyme Group, has officially launched in the Philippines.

The venture adapts a “phy-gital” model, combining both the physical touchpoints such as kiosks and secure digital transactions online via its app to help Filipinos with their financial needs.

As previously reported, GoTyme Bank received its Certificate of Authority (COA) to operate from the Bangko Sentral ng Pilipinas last August. A month after, it partnered with BancNet and Visa.

With a high-tech approach, GoTyme Bank offers customers to open an account in just five minutes through its kiosks, for them to avail services such as:

- bank transfers

- shopping rewards

- interest savings

- trading

- investing

- customer service

Not only that, GoTyme will also have a debit card, rivaling the likes of Maya and GCash MasterCard. This allows customers to make transactions from local and international ATMs, including free transactions at Robinsons-affiliated retail outlets.

Currently, there are already 15 kiosks in select Robinsons supermarkets, with more locations set to open soon.

Send, shop, save

GoTyme Bank is also leaning on its Send-Shop-Save value proposition in hopes of standing out against rivals.

The service offers three free transfers a week straight from the app, on top of always free intra-GoTyme transfers.

The Go Shop feature, meanwhile, gives customers a better shopping experience, as each swipe of their GoTyme debit card will lead to GoRewards points at partner Robinsons stores. These points may be redeemed afterwards.

Lastly, Go Save lets patrons earn interest with no worries on promo durations and minimum balances. The “Save Your Change” feature will let people save too by rounding up to the nearest 10 or 100 pesos and putting that excess change automatically into a Go Save account.

All-in-one digital bank Maya is urging Filipinos to make their bonus work smarter, grow faster, and set them up strong for 2026.

As it is already the Christmas season, most Filipino professionals have just received or will be receiving their 13th month pay. But before that disappears into holiday hauls, Maya has tips so users be on top of their finances.

Give your extra money an assignment

Bonuses aren’t a windfall; it’s a strategy. Before anything else, Filipinos should give every peso a purpose.

A simple split could look like this:

- 50% bills and responsibilities

- 30% for fun

- 20% for savings and investments

For payments, it makes sense to use Maya. This holiday season, the banking app has a TWINYONARYOS promo wherein a user and a chosen referral can both win PhP 1 million each.

Park money for the future

Those who already have a Maya account can also take advantage of Maya Savings, where money can grow with up to 15% p.a. interest credited daily.

Then, build structure with Maya Personal Goals. Users can create five different goal accounts on the app, each earning 4% base interest. The rate also increases every PhP 20,000 added.

But for those who wants bonus to grow steadily and predictably, Time Deposit Plus comes in handy. Lock money for 3, 6, or 12 months with guaranteed rates of up to 6% p.a. on deposits up to PhP 1 million per TDP account.

Build a buffer for life’s curveballs

Lastly, users can boost their emergency fund using Maya Savings or set up a dedicated Personal Goal just for emergencies.

Maya Easy Credit also gives instant access to funds with no paperwork or collateral so you don’t have to touch your hard-earned savings when things get tough.

Apps

Turn your cravings into cashback with this new credit card

EastWest, Visa, and foodpanda created a lifestyle card that rewards your everyday life in the most delicious way!

There comes a moment in every busy, convenience-loving yuppie’s life when the heart encounters something that simply gets it.

For many, that moment will happen the first time they hear about the new EastWest foodpanda Visa Credit Card.

This cobranded creation from EastWest, foodpanda, and Visa feels like a treat wrapped inside another treat, made for those who thrive on ease, comfort, and a healthy dose of instant gratification.

Think of all the small joys in your routine. The iced latte that turns your morning around; the comforting order that saves an exhausting weekday; or the impulsive midnight craving that somehow counts as self-care.

Now imagine every craving quietly earning something meaningful in return. That is the lifestyle this card was built to support.

Cashback that keeps the cravings flowing

Cardholders receive 10 percent cashback on all foodpanda orders with earnings of up to Php 400 each month.

Cashback continues at 3 percent even after reaching the cap, which keeps rewards flowing for frequent orders.

Users also receive 1 percent cashback on overseas transactions and 0.3 percent on other local purchases. All cashback across categories has a combined limit of Php 1,000 per month.

The card is free of annual fees during the first year and early users receive a complimentary six month pandapro subscription.

Cashback is credited weekly to the user’s pandapay wallet for immediate access. This weekly reward cycle is a first in the local market. It reflects foodpanda’s focus on instant gratification and smooth digital experiences.

EastWest, foodpanda, and Visa aligned on a single goal. They wanted a card that fits into everyday routines, feels simple to use, and delivers rewards in a fast and friendly way.

Lifestyle card for a lifestyle-first way of spending

Younger Filipino consumers are embracing credit cards that care about their lifestyle choices.

The EastWest foodpanda Visa Credit Card fits right into this shift, giving people a financial tool that rewards the habits they already enjoy.

It creates a gentle nudge toward smarter spending without taking away the fun or the flavor.

Visa’s global network makes tap-to-pay transactions fast and secure. With automatic weekly cashback and worldwide acceptance, the card creates a rewarding experience that enhances how Filipinos dine and enjoy their favorite cravings.

This card understands one universal truth: Every order has the potential to be more than a meal. Now, it comes with rewards ready to follow you everywhere.

To learn more or start your application, visit eastwestbanker.com/foodpanda or tap ‘Apply Now’ on the foodpanda app.

Apps

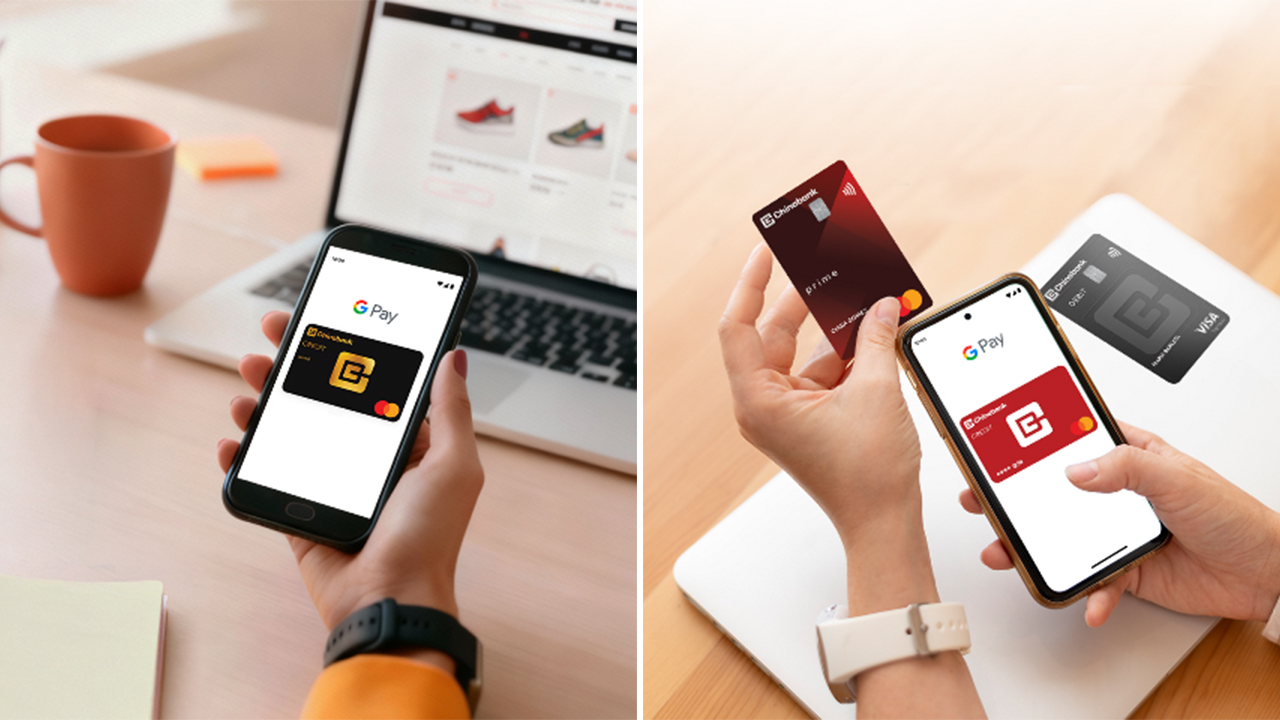

Chinabank makes tap to pay easier with Google Pay

A smoother and more secure way to pay is now available!

Cashless life just got a whole lot easier!

Chinabank is now one of the first Philippine banks to support Google Pay for both Credit and Debit Cards, whether you’re using Mastercard or Visa. If you’ve ever wished you could breeze through checkout without digging for your wallet, your moment has officially arrived.

With this rollout, Chinabank customers can add their cards to Google Wallet and start making fast, secure, tap-to-pay transactions using only their phones.

In stores, in apps, and on your favorite online shops, paying becomes as simple as unlocking your device and tapping. No more scrambling for plastic cards at the bottom of your bag.

Google Pay uses secure digital tokens for every transaction, which means your actual card number stays private. Even if you shop daily or travel often, your payments stay protected. It’s the kind of small upgrade that makes everyday errands feel smoother and more modern.

As digital payments become the norm across the country, Chinabank’s move helps speed up the shift. Whether you’re grabbing coffee, doing a grocery run, or checking out online, you now get a payment option that feels more intuitive and more secure.

How to add your Chinabank card to Google Wallet

- Download Google Wallet from the Play Store and open the app.

- Tap “Add to Wallet” then choose “Payment Card.”

- Scan or manually enter your Chinabank Credit or Debit Card details.

- Complete the verification steps.

- Once approved, you’re ready to tap and pay.

How to use Google Pay

- In-store: Unlock your phone and hold it near a contactless terminal until it confirms the payment.

- Online: Select Google Pay at checkout for quick and secure payments.

- Security: Each transaction uses a unique digital card number or biometric verification, keeping your information safe.

Chinabank is also preparing guides and support channels to help customers get familiar with Google Pay, making the shift to digital wallets easier for everyone.

With Google Pay now part of its digital ecosystem, Chinabank gives its customers a payment experience that’s faster, safer, and ready for modern life.

-

Reviews2 weeks ago

Reviews2 weeks agovivo X300 Pro review: Going the X-tra Mile

-

News2 weeks ago

News2 weeks agoHUAWEI nova 14 Series, MatePad 12 X (2026) now in PH

-

Gaming2 weeks ago

Gaming2 weeks agoYou can play SNES games on this Nike shoe

-

Drones7 days ago

Drones7 days agoAntigravity A1 review: A new way to fly

-

Reviews1 week ago

Reviews1 week agoHONOR X7d: Dependable, but not dazzling

-

Gaming1 week ago

Gaming1 week agoRazer Raiju V3 Pro review

-

Lifestyle1 week ago

Lifestyle1 week agoShokz OpenFit 2+ review: A love letter to an ultramarathoner

-

Gaming1 week ago

Gaming1 week agoAnno 117: Pax Romana helps you get into strategy games