Security

Nuki Smart Lock, innovative keyless access solution, now in the US

Award-winning product in Europe hits US market

Nuki’s award-winning Smart Lock has released in the United States. This innovative product developed in Austria and manufactured in Europe offers American consumers a smarter lock choice.

The Nuki Smart Lock combines cutting-edge technology, privacy, and a customer-centric premium design. In addition, there is an intuitive app developed for an optimized user experience.

The Nuki Smart Lock allows users to unlock doors conveniently and automatically under a second. This mechanism is enabled by a cutting-edge brushless motor technology, offering the same efficiency, durability, and performance commonly found in electric vehicles.

As part of the adjustments for the market, the Nuki Smart Lock available in the United States effortlessly retrofits onto existing U.S. single-cylinder deadbolts.

The compact design is only 2.2 inches in diameter and comes with a sleek, stainless steel body and black base ring. Quick installations under 15 minutes are possible, minus drilling or modifications.

The keyless access solution has native Matter support, as well as compatibility with Apple Home, Amazon, Alexa, Google Home, Samsung SmartThings, and more.

Moreover, the product is designed with end-to-end encryption commonly used by online banks. Its battery life, meanwhile, can last up to 12 months.

The Nuki Smart Lock is now available via Amazon for US$ 229 including a Keypad 2. This add-on includes access code and fingerprint options.

The lock on its own retails for US$ 159. Various accessories include a Nuki Keypad with code option (US$ 89), Keypad 2 (US$ 149), and Door Sensor (US$ 59).

In addition, there is a Nuki Premium subscription available for US$ 5.90 a month. This includes full remote access via the Nuki app, real-time activity alerts, and a two-year immediate product replacement.

Apps

Don’t get tricked: Spot these financial monsters before they get you

Ghosts are harmless compared to these real-life threats that prey on your hard-earned money.

The spooky season has arrived, but not all monsters wear masks. Some hide behind fake links and shady offers designed to trick you into giving up your hard-earned money.

These are the real-life financial monsters: fraudsters, impersonators, and manipulators who turn everyday moments into horror stories.

According to the Cybercrime Investigation and Coordinating Center, 32% of Filipinos have fallen victim to digital fraud in the past year. And while it’s tempting to think you’d never fall for one, scammers are getting smarter and more creative.

Here’s what to watch out for:

Suspicious links and emails.

Those random texts and emails saying “there’s a problem with your account” or “you’ve won a prize”? They’re classic traps.

Scammers disguise themselves as legitimate companies to steal your information or access your accounts. Always double-check the sender’s address. If it looks off, don’t click.

Grammar gone wrong.

If a message is full of weird typos, awkward phrasing, or off punctuation, that’s a red flag.

Reputable companies review every message they send. When in doubt, don’t reply. Report it to authorities like the PNP Anti-Cybercrime Group or the NBI.

Urgent and emotional messages.

Scammers love to pressure you. They’ll make you feel scared or guilty to get you to act fast.

Real companies won’t threaten or rush you into sharing personal info. Take a breath, hang up, and reach out to the official hotline to verify.

Deals that sound too good to be true.

If someone promises instant money or massive discounts, run. These scams often demand “processing fees” or personal info before disappearing. No legitimate prize will ever require payment upfront.

Behind every scam is a story of someone who deserved better. Sometimes, what started as a simple loan application can turn into a nightmare if a rogue online lender decides to harass someone over payments they didn’t even fully receive.

It’s a familiar story for many Filipinos who’ve been preyed on by unregistered or unethical financial services.

Thankfully, more responsible lenders and financial platforms today (Tala, for example) are working to raise awareness and fight back against these threats.

Some even use advanced systems to flag suspicious behavior, partner with authorities for investigations, and educate communities through financial literacy programs.

At the end of the day, awareness is your strongest defense. So this Halloween, stay sharp because protecting your peace (and your money) will always be the sweetest treat.

News

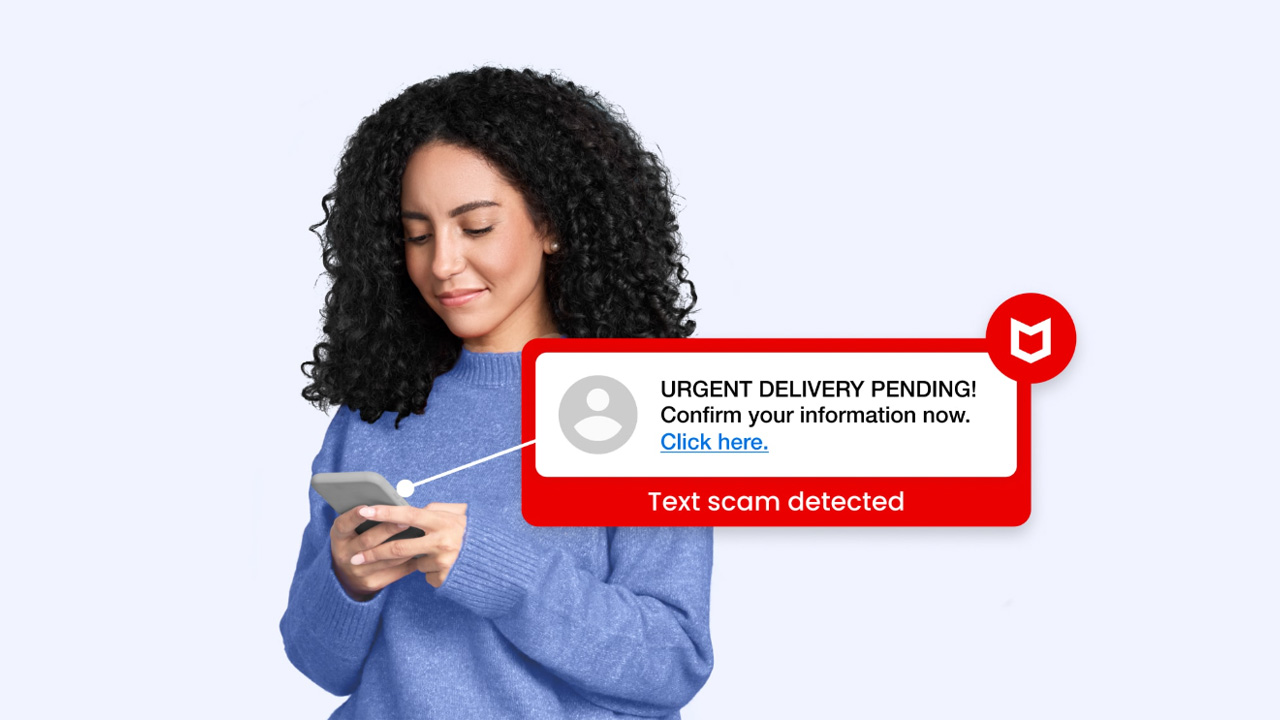

McAfee rolls out an easy way to detect scam texts and emails

Plus, they have a much lighter app.

Scammers are getting more brazen these days. Instead of going through the same scripts, malicious actors are now going for more robust schemes to impersonate official accounts. It’s impossible to go through a single week without a warning to never trust suspicious senders or links. To fight the latest wave of malicious parties, McAfee is launching new features to more easily find and eliminate potential threats.

As reported by McAfee, 88 percent of Americans have encountered a scam in the past year. The average person sees about 14 scams on a single day. And it’s not just exclusive to the United States. Everyone all over the world is falling prey to scammers more accurately presenting themselves as legitimate accounts.

Introducing the McAfee scam detector

To fight this, McAfee now has a scam detector. Using the power of AI, the antimalware service can scan both text messages and emails for potential scams. It can also block suspicious links for you.

Now, because the software now uses AI, it can also use the same technology to more easily present why it found a threat. In the past, McAfee just showed users the errant file and called it a day. Now, the software offers readable explanations as to why the detected file might be a threat. It’s the perfect tool for those who aren’t savvy with computers.

Additionally, the same feature can analyze videos to see if they’re deepfakes. Of course, not every deepfake is a scam. But knowing if a video might be generated is a crucial skill these days.

A much lighter app

Despite adding a significant feature against modern scams, McAfee has somehow made its software lighter for modern PCs. According to a performance test from AV-Comparatives, McAfee ranks the lightest compared to other titans in the segment including Avast, AVG, and Kaspersky. Basically, using McAfee takes the least toll on your PC.

More interestingly, this comparison includes Microsoft Defender. There used to be a time when experts said that Microsoft’s built-in antivirus software was much better than most paid services. Now, it seems McAfee is fighting back against the claim by offering a much lighter service that can work in the background without interrupting whatever you’re doing.

Available on all plans

Importantly, McAfee’s new scam detector is available on all plans. It’s also available for mobile, tablet, and PC use.

However, it isn’t available for all territories yet. McAfee is still working to get the feature implemented in other languages.

News

No, your Gmail wasn’t hacked this weekend

Google debunks viral hack warnings as “entirely false”

If you were on social media this past weekened, you might have noticed an urgent warning to change your Gmail passwords. According to some viral posts, Google reportedly suffered a major security breach due to a Salesforce attack. Today, the company is claiming that the reports are false and that Gmail security is still as strong as ever.

This entire story stems from a recent Salesforce breach confirmed back in June. Since Google uses Salesforce as part of its backend, the confirmed attack technically affected Gmail users. The company said that it had finished notifying affected users already in early August.

This week, the same issue popped up once again. However, this time, the viral threads are claiming that all 2.5 billion Gmail users are affected. They further suggest a change of passwords to avert potential hacks.

Today, Google has issued a statement to debunk the rumors as “entirely false.” Though the statement does not explicitly name the actual reports, the timing clearly points to the recent trends.

Of course, it’s still best practice to regularly update passwords. Google even confirms that phishing attempts happen all the time, but Google’s security blocks these threats 99.9 percent of the time (according to them, at least). At the very least, there is no reason to panic.

There are a lot more security measures available today, besides passwords. Users can add the more traditional two-factor authentication. Alternatively, devices these days can already support passkeys — a more secure method that relies on device identity, rather than a user’s identity.

SEE ALSO: Gmail now makes it easy to unsubscribe from all marketing emails

-

Accessories2 weeks ago

Accessories2 weeks agoThis gaming mouse made me fall in love with working from home again

-

Laptops1 week ago

Laptops1 week agoSpotlight: ASUS ProArt P16

-

News2 weeks ago

News2 weeks agoFrom OS to AI OS: HONOR announces MagicOS 10

-

Accessories2 weeks ago

Accessories2 weeks agoI was skeptical about smartphone gimbals, then I tried the DJI Osmo Mobile 8

-

Gaming2 weeks ago

Gaming2 weeks agoRazer, JOOLA partner for limited-edition pickleball paddle

-

News1 week ago

News1 week agoThe Mate 70 Air is HUAWEI’s clapback to the iPhone Air

-

Reviews2 weeks ago

Reviews2 weeks agoPredator: Badlands is the adventure comedy that the series needs

-

Gaming2 weeks ago

Gaming2 weeks agoThe Nintendo Switch is nearing the end of its lifecycle