Apps

Zoom is now rolling out end-to-end encryption for free, paid users

But there’s a twist

Video conferencing service Zoom has announced it’s rolling out end-to-end encryption for all users globally. It’s now available for users as a technical preview for the next 30 days and users can provide feedback.

The technical preview means the company is still working on the feature and user feedback could bring changes to the end implementation. End-to-end encryption means that the company hosting the service too cannot snoop around. The encryption key is saved with the user and all communication between two people remains secured.

The feature is opt-in only, meaning users have to manually go to the Settings tab and enable end-to-end encryption. You’ll also be prompted to create a one-time passcode, which Zoom says will help them prevent abuse. By default, Zoom meetings and webinars use AES 256-bit GCM encryption for audio, video, and application sharing.

Due to the added security layer, you won’t be able to dial-in on calls via an ordinary phone. Additionally, it’ll disable a few features like join before host, cloud recording, streaming, live transcription, Breakout Rooms, polling, 1:1 private chat, and meeting reactions.

End-to-end encryption is available on Mac and PC, the Zoom Android app, and Zoom Rooms. It’s yet to roll-out on iOS since the updated patch hasn’t received approval from Apple’s App Store yet.

Zoom says that this is just a part of their security update and the company plans to roll out better identity management and E2EE SSO integration as part of phase 2. Altough, the latter is scheduled for 2021.

Lastly, Zoom for Android has received a new update and it brings along support for live streaming to YouTube.

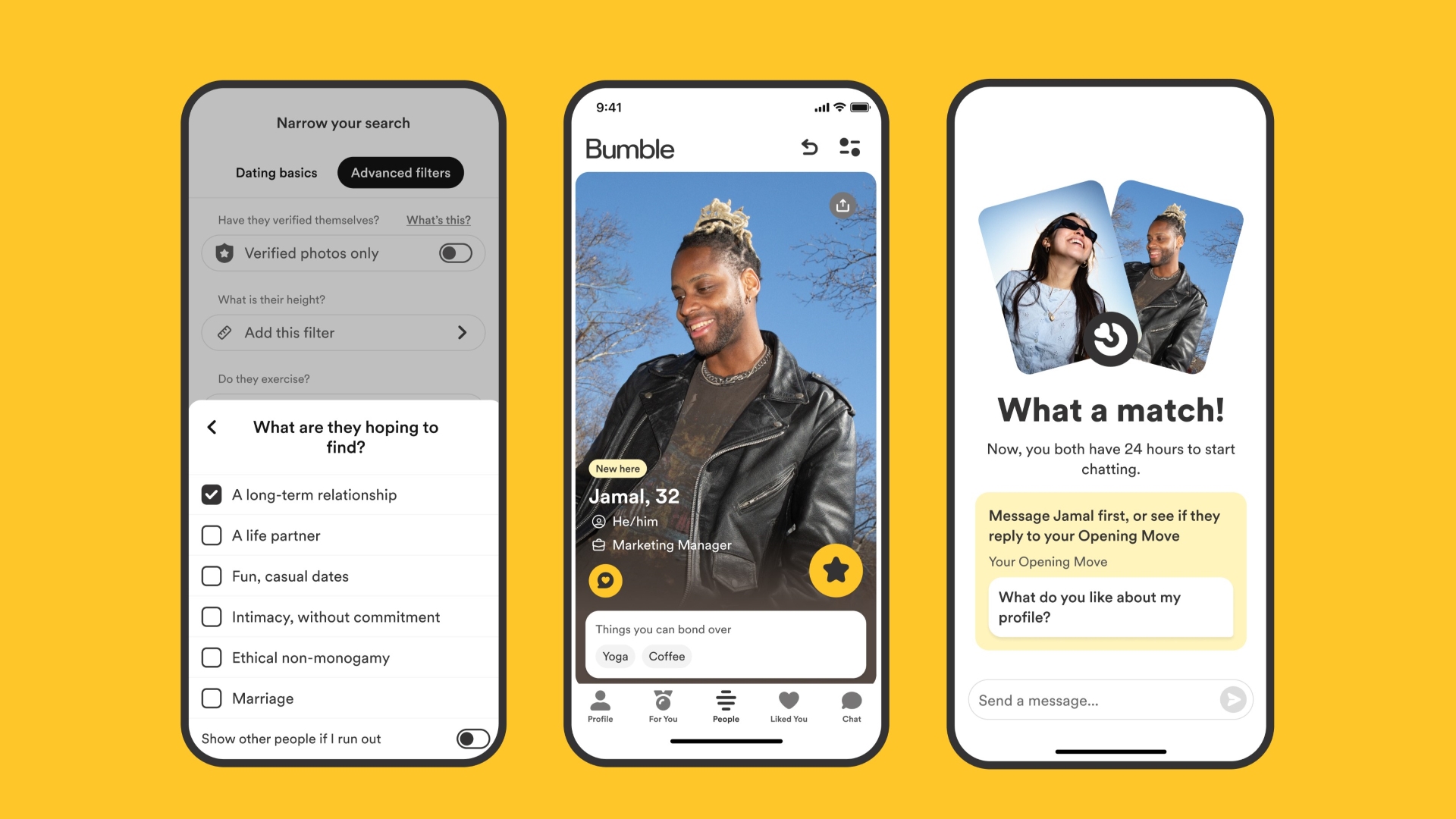

Bumble is ushering a new era of dating. The dating app has just rolled out a new brand design. This includes a new logo and user interface with bolder fonts and refreshed colors and illustrations. Along these are many significant updates to the app’s features, giving users better ways to connect with others.

For instance, Bumble has added hundreds of new prompts and have refreshed the prompts UI to help members show off their personalities easier. Shared interests have also been moved to the top of the profiles for users to better spot commonalities. This gives users a snippet of profiles for them to know right away what they have in common. Furthermore, the app has also increased the number of required profile photos to four to boost the likelihood of matches.

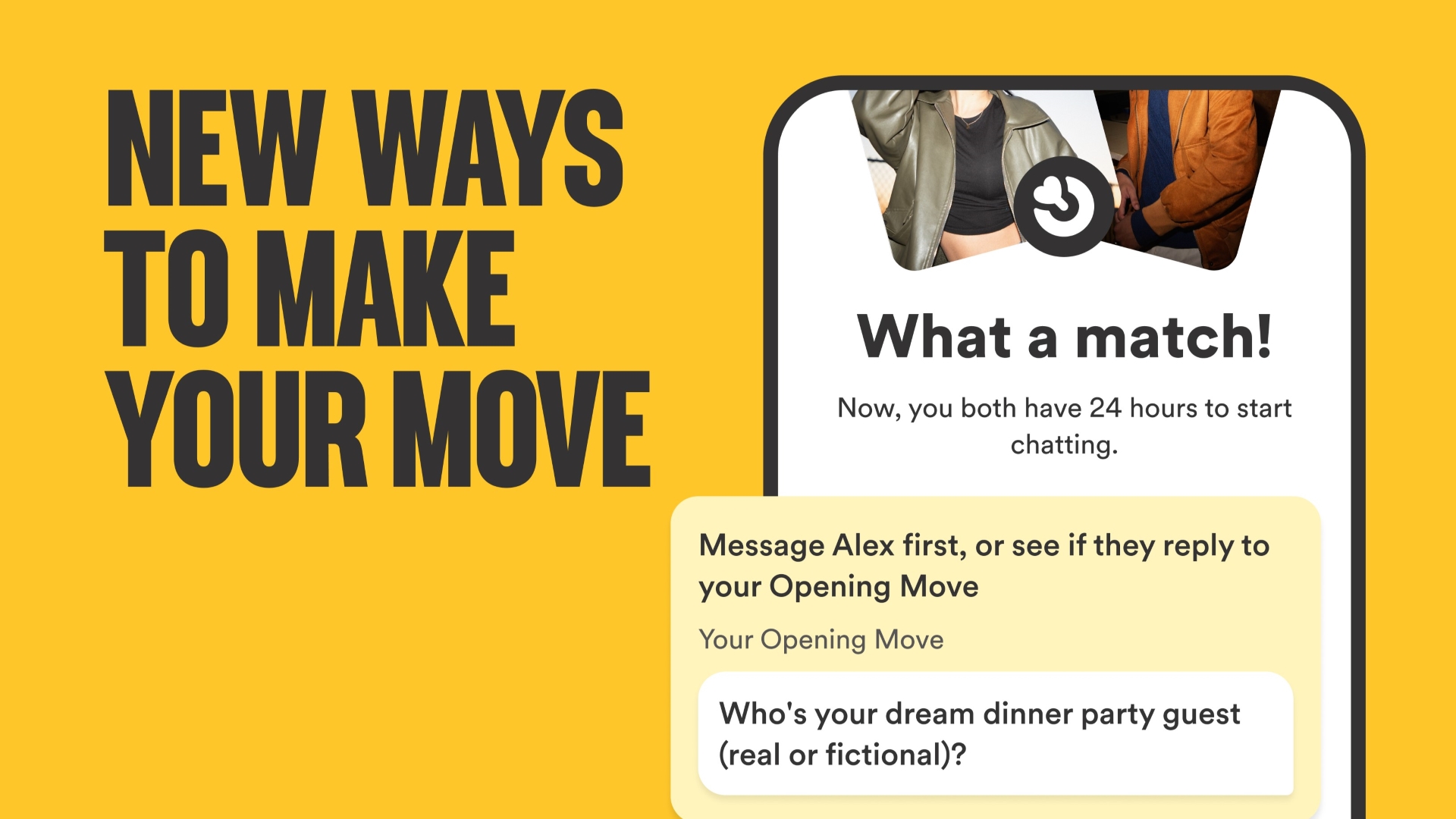

Among the new features on Bumble is Opening Moves. This allows women to set a post-match question for their connections to respond to within 24 hours. This facilitates a more meaningful connection and introduces another way to connect outside of Bumble’s Make The First Move. Of course, they may directly message their match even if they haven’t responded to the post-match question.

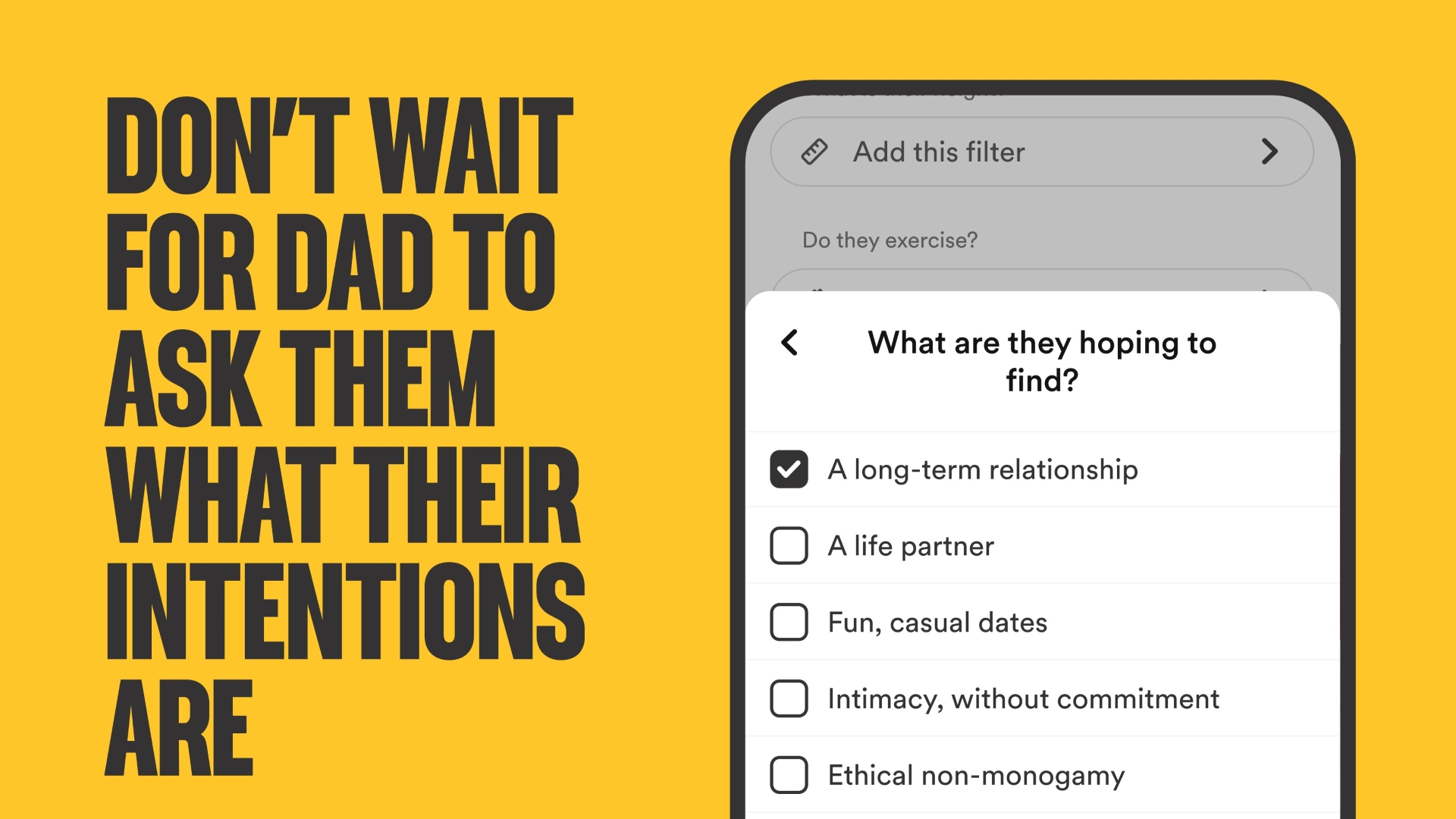

Meanwhile, Bumble has also expanded its Dating Intentions right from the setup. This is so users can answer the question “What are you hoping to find?” with more accurate choices. Among these are Long Term Relationship, Life Partner, Fun, Casual Dates, Intimacy without commitment, Ethical non-monogamy, and Marriage.

This change stemmed from a Bumble survey that saw 68% of women struggle with people not being upfront about their dating intentions. When browsing, the expanded dating intentions badges will show right below the person’s profile’s “About me” in a section called “I’m looking for.”

Moreover, Bumble has renamed Best Bees to For You. Bumble is employing a new machine learning model to give users their daily set of four curated and relevant profiles based on preferences and past matches.

The changes are part of Bumble’s mantra to empower women to make the first move, flip gender roles, and take control of their dating app experience and dating life in general.

TikTok lost its voice a few months ago. Back in February, the platform lost its rights to use and offer music from artists affiliated with the Universal Music Group. A few weeks ago, Taylor Swift, the biggest artist in that group, returned to the platform. Now, other artists are following suit.

In an official press release, Universal Music Group has announced a new licensing agreement between its artists and TikTok. As a result, users can once again fill their videos with music from artists such as Olivia Rodrigo and BTS.

With the new deal, TikTok’s woes in the music department are finally at an end. When the past deal ended, Universal initially refused a renewal, alleging that TikTok does not adequately pay artists for the use of their music. Once the deadline passed, TikTok was suddenly silent. Existing videos lost their music, and newly minted ones could not use the most popular selection of songs today.

Not surprisingly, Taylor Swift was ahead of the curve. Presumably because of her ownership over her masters, the world’s biggest musical artist returned to the platform without a new Universal deal. The return also came in time for Swift’s latest album, The Tortured Poets Department.

Now, the platform finally has Universal’s entire selection back. If your videos need that extra spice, now’s the time to get back into it.

SEE ALSO: Taylor Swift is back on TikTok

Huawei will soon have its own painting app specifically designed for tablets: GoPaint. This makes the manufacturer the first to have its own self-developed painting app.

Huawei already teased its audiences with a short clip posted on its socials with the caption “Creation begins here.” GoPaint will go live on May 7.

The app will come with a wealth of brushes, and brings easy-to-use features for painting. The eventual launch of this app eliminates the need for beginners to download third-party apps, like ibis Paint X and Sketchbook.

With the integration of GoPaint along with Huawei’s capable hardware-software architecture, Huawei is pushing itself to be a creation go-to for tech users. Previously, the brand held a GoPaint Worldwide Creating Activity last year, which saw creators around the world participate.

The app will surely complement Huawei’s recent lineup of tablets which includes the MatePad 11.5 PaperMatte edition and the MatePad Pro 13.2.

The PaperMatte edition tablet eliminates glare and prevents reflection and fingerprints, replicating the feel of traditional paper. On the other hand, the MatePad Pro 13.2 offers users a smooth and seamless experience for creation, work, content consumption, and more.

The MatePad Pro 13.2 particularly features an OLED screen and works with Huawei’s 3rd gen M-Pencil for more than 10,000 pressure sensing levels. Both tablets support multi-device interconnection, remote PC access, and multi-screen collaboration.

-

Reviews1 week ago

Reviews1 week agoOnePlus 12R review: Making sense of OnePlus’ latest flagship

-

Reviews2 weeks ago

Reviews2 weeks agorealme 12 5G review: It was enchanting to meet you

-

Smartphones1 week ago

Smartphones1 week agoHuawei Pura 70 Pro Unboxing and First Impressions

-

Convenient Smart Home7 days ago

Convenient Smart Home7 days agoI swear, Samsung’s The Freestyle spells freedom

-

Reviews7 days ago

Reviews7 days agoXiaomi Pad 6S Pro 12.4 review: Bigger and better

-

News2 weeks ago

News2 weeks agoZTE nubia Neo 2 5G now in the Philippines: Pricing, details

-

Smartphones2 weeks ago

Smartphones2 weeks agoHMD announces 1st line of own smartphones

-

Smartphones1 week ago

Smartphones1 week ago‘Esports-level’ Infinix GT 20 Pro now official