Enterprise

Why the NVIDIA-Arm deal is unlikely to get approval from China

Geopolitics taking over the technology world

British chip designer Arm is a very unique company in today’s world. Monopolies are despised and regulators are always on the lookout for antitrust practices. Despite this, Arm’s chip design is used in pretty much every modern gadget, giving it an unprecedented level of technology control.

Whether it’s your Android or iOS smartphone, tablet, work machine, or a tiny smartwatch, all of them leverage Arm’s chip design. With the IoT boom, more and more devices are leveraging these technology stacks. We can compare Arm to a golden goose, it’ll keep giving healthy rewards as long as it’s neutral and follows standardized licensing.

The existing model has given Arm more than 90% market share and a considerable edge against rivals like Intel and AMD. However, experts are concerned the recent acquisition of Arm by Nvidia could spark regulatory trouble. Nvidia announced it’ll be buying Arm for US$ 40 billion from Japanese giant SoftBank.

The proposed transaction will need regulatory approval from the US, the UK, the EU, and China.

Understanding how Arm operates

Arm’s success is based on its neutral nature — it doesn’t manufacture chipsets and keeps a low-key profile in terms of marketing. Instead, it silently licenses its IP (intellectual property) to companies for direct use. These customers are then free to modify, manufacture, and market these chips easily.

To be more precise, manufacturers license ARM’s architecture or instruction sets. They determine how processors handle commands. This option gives chip-makers greater freedom to customize their own designs. In the end, Samsung’s Exynos, Qualcomm’s Snapdragon, Huawei’s Kirin, and Apple’s A-series rely on Arm for chip designs.

Arm’s direct rival in the chip designing space is Intel, who utilizes a different architecture called the x86. However, Arm’s designs are known for their power efficiency and have proven to be superior. No other company has been able to make a significant impact against Arm’s might. According to Arm, more than 180 billion chips with its processor cores and other components have been shipped around the world.

Arm is purely a technology company that gets along well with everyone. Arm co-founder Hermann Hauser describes the company as “the Switzerland of the semiconductor industry” because of its approach. The technology is universally available and anyone can get a piece of it. And, with a spotless track record of three decades, the company is considered stable despite international political unrest.

The company was sold to SoftBank in 2016 and there were concerns in China about a Japanese giant owning a key technology asset. China and Japan have a strained relationship, but the deal emphasized that SoftBank won’t hinder Arm’s business strategy and key decisions. And hence, the transaction went through.

US vs China trade war

The world has changed radically in the last four years. The US and China were embroiled in an extended trade war, the Coronavirus pandemic has soured international relations, and the US now wants to ban TikTok and WeChat. Huawei has lost access to key channels like Google Mobile Services, disrupting its mobile division. The telecom giant’s 5G ambitions are on hold due to increased security scrutiny in many countries like Australia, Germany, and India.

Right now, Chinese investors hold a majority stake in it’s China operations, and this division makes up 20 percent of Arm’s annual revenues. Hence, a nod from the Chinese regulator plays a critical role in the deal to go through.

An opinion piece in state-backed Global Times said, “If Arm falls into U.S. hands, Chinese technology companies would certainly be placed at a big disadvantage in the market.” Chinese regulators haven’t spoken publicly about the deal, but state-run media is often viewed as a barometer of sentiment among senior officials.

If Arm comes under Nvidia’s control, the US government will also have more power against China in the technology race. Chinese companies Huawei, ByteDance, ZTE, and WeChat have faced severe sanctions, crippling their business. A lot of Chinese companies rely on Arm’s technology and Huawei’s Kirin lineup is drastically affected due to the ongoing trade sanctions.

Geopolitical climate playing a role in the deal

In 2018, China rejected Qualcomm’s offer to takeover American-Dutch semiconductor maker NXP. The deal was worth US$ 44 billion. The NVIDIA-Arm deal will take almost 18 months to complete, during which the ongoing geopolitical crisis could play a pivotal role.

NVIDIA and Arm have offered reassurances that the British firm will remain neutral. As part of NVIDIA, Arm will continue “maintaining the global customer neutrality that has been foundational to its success,” the companies said in a statement.

The boilerplate release doesn’t look very reassuring though. On September 26, the US imposed restrictions on exports to China’s biggest chip maker SMIC. It said the company may pose an unacceptable risk of diversion to military end-use.” SMIC has denied any ties to China’s military.

Following the restriction, Global Times published another article stating, “It now appears that China will need to control all research and production chains of the semiconductor industry, and rid itself of being dependent on the US.”

The indications are clear, China is increasingly concerned about technological independence. The internet grew on the back of globalization, but in the last few years, calls for localization have grown louder. The NVIDIA-Arm deal will be a testing point for international trade and diplomacy.

Enterprise

ACMobility Launches ChargeFleet: Seamless solution for businesses

B2B solution for corporate fleets and transport groups

Ayala Group’s ACMobility has launched ChargeFleet, a new B2B digital solution for corporate fleets and transport groups.

The new service introduces a shareable digital wallet that streamlines charging expenses, reduces manual tracking, and improves cost control.

As more organizations explore electrifying their mobility operations, many continue to face operational challenges — including fragmented payment systems, reimbursement delays, and limited visibility over charging usage.

ChargeFleet addresses these gaps by introducing a centralized, shareable digital wallet. Here, fleet managers can allocate and monitor charging credits across multiple drivers across a single platform.

The system is a seamless process designed for long-term usage and easy deployment across any organization.

Once integrated, ACMobility assigns charging credits to the client’s fleet manager. The manager then can distribute these to multiple drivers. Meanwhile, the latter will be able to see and use their assigned credits via the Evro app.

ChargeFleet is available as a prepaid product through the ChargeFleet Store. Users can buy offers via GCash or credit card. No application process is required.

Looking ahead, ACMobility will continue to enhance the ChargeFleet experience with exclusive value-added perks integrated through Evro and Power on Wheels.

The upcoming features highlight ACMobility’s ongoing push to provide a future-proof support system for the evolving needs of their customers’ businesses.

Enterprise

Sony teams up with 13 companies for sustainable global supply chain

Sustainability through introduction of renewable plastics

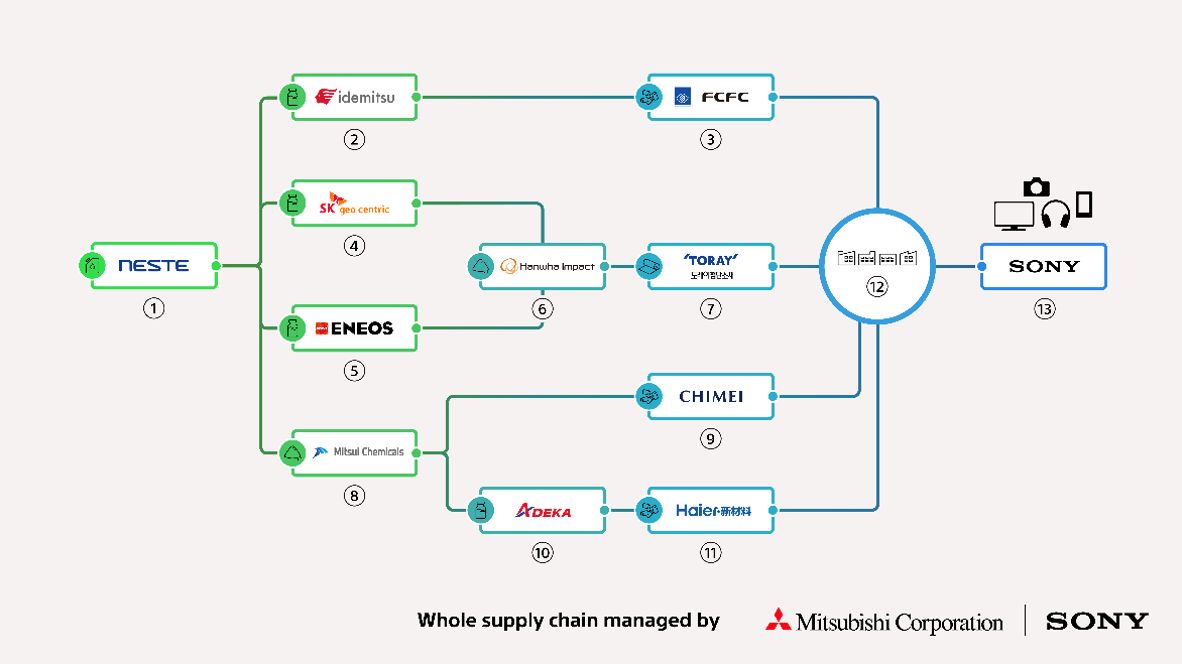

Sony, along with several companies, have established the world’s first global supply chain for the production of renewable plastics that can be used in Sony’s high-performance audiovisual products.

The supply chain consists of 14 companies across five countries and regions. The various plastic materials manufacture through this supply are slated for use in Sony’s products that will launch worldwide.

High-performance products such as audiovisual equipment involve a wide variety of plastics. The result is a complex supply chain that makes it difficult to visualize and manage the entire flow.

Additionally, plastic components that require high performance in terms of flame resistance and optical properties cannot be fully replaced with plastics from material recycling.

To address these challenges, these 14 companies have collaborated to visualize the existing supply chain for Sony’s products:

- Sony Corporation

- Mitsubishi Corporation

- ADEKA CORPORATION

- CHIMEI Corporation

- ENEOS Corporation

- Formosa Chemicals & Fibre Corporation

- Hanwha Impact Corporation

- Idemitsu Kosan Co., Ltd.

- Mitsui Chemicals, Inc.

- Neste Corporation

- Qingdao Haier New Material Development Co.

- Ltd., SK Geo Centric Co., Ltd.

- Toray Industries, Inc.

- Toray Advanced Materials Korea Inc.

Sustainability through renewable plastics

The new supply chain created will enable the production of multiple types of renewable plastics from biomass resources with a mass balance approach.

This allows Sony to proactively source raw materials for its products with quality, as well as properties equivalent to virgin fossil-based plastics.

Defining the supply chain also helps the companies track and document GHG (Greenhouse Gas) emissions data in a verifiable way.

This allows participating companies to leverage the data to advance efforts to reduce their carbon footprint going forward.

Sony’s initiative with a wide range of global partners is part of the “Creating NEW from reNEWable materials” jointly launched by the electronics giant and Mitsubishi.

It aims to achieve zero usage of virgin fossil-based plastics through the introduction of renewable plastics.

Enterprise

realme is reportedly going back to being an OPPO sub-brand

All scheduled phones will still launch on time, though.

A popular story among Chinese smartphone brands is whenever a sub-brand spinning off into its own independent entity. A less common one is when an independent entity suddenly merges back into the main entity. And yet, that’s the story we have today. realme is reportedly going back to being a sub-brand of OPPO.

If you don’t remember realme’s time as a sub-brand, then it’s hardly your fault. It’s been a long while since realme was considered a sub-brand. In 2018, the brand spun off on its own to form one of the most popular names in the Chinese smartphone space.

Today, via Leiphone, realme will return to OPPO as a sub-brand. Current realme CEO Sky Li will still retain his responsibilities heading the brand. Plus, all products on the current release schedule will still come out as planned.

However, starting this year, realme will start reintegrating back into OPPO, particularly through the latter’s after-sales programs. OnePlus will also follow the same structure going forward.

Currently, realme has not officially announced the move. That said, we also don’t know how the brand will address the reported change. It’s possible that the shift is just internal and has no effect on how the brand faces the public. For now, only time will tell.

SEE ALSO: realme C85 with 7000mAh battery, 5G connectivity officially launches

-

Reviews2 weeks ago

Reviews2 weeks agoThe art of being in and behind the frame

-

Gaming2 weeks ago

Gaming2 weeks agoGod of War Greek trilogy remake in development, Sons of Sparta out now

-

India2 weeks ago

India2 weeks agoTECNO POVA Curve 2 5G packs an 8000mAh battery

-

Accessories2 weeks ago

Accessories2 weeks agoSony WF-1000XM6 is out now: Price, availability

-

Gaming2 weeks ago

Gaming2 weeks agoNew Resident Evil Requiem trailer teases a return to the RPD

-

Accessories2 weeks ago

Accessories2 weeks agoApple AirTag 2 Review

-

Gaming2 weeks ago

Gaming2 weeks agoJohn Wick, Kena sequel, more new games showcased at State of Play

-

Cameras1 week ago

Cameras1 week agoOsmo Pocket 4 makes a surprising appearance in public