Apps

How QR codes and BDO Pay can support the adventurer in you

Balancing cashless, cash transactions

You’ve probably already used a Quick Response code especially in the last few years. Simply known as QR codes, this technology serves various purposes, from providing shortcuts to online links to filling out survey or appointment forms and more.

But arguably its most popular application in digital space is for convenient and seamless cashless transactions. After all, the advent of technology has made it easier for individuals to manage their banking and finances, as well as to transact practically on a daily basis.

With QR codes continuing to become more prevalent, BDO Pay uses them in many ways to make these transactions – digital or not (yes, cash) even more convenient.

Supporting the adventurer in you

One of BDO’s banking innovations to stay ahead of the curve, BDO Pay strikes a convenient balance between cashless transactions and even scenarios that require the use of cash.

Together with smartphones, BDO Pay can support the adventurer in you by providing fast, easy, and secure payments for whatever you’ll need throughout your trip.

It’s safe to say that smartphones have become the modern swiss army knives for most people. These handy devices serve as their portable cameras, sources of entertainment, communication tools through social media and other platforms, and even mini workstations through Microsoft and Google.

And for enthusiasts going on a quick vacation, a concert, or even watching sporting events or attending a toy fair, all they need nowadays to enjoy their trips are their phones and BDO Pay (and QR codes, of course).

A convenient balance

Suppose you’re at a toy fair at the SMX Convention Center, Mall of Asia and you’ve underestimated how much you actually needed for all the collectibles present there.

BDO Pay lets you transact with merchants as long as they have QRPh. By just scanning the merchant’s QRPh code, you can already pay using the BDO Pay app.

And for scenarios where only cold hard cash is accepted, BDO Pay offers the same convenience. Using the app, just generate a QR code, head to the nearest BDO ATM, and facilitate a cardless cash withdrawal.

You read that right: there’s no need to enter your account details or insert an ATM card anymore. That way, you only need your phone and the BDO Pay app.

Besides, as BDO is one of the foremost banking institutions in the country, spotting a BDO ATM is as easy as 1-2-3.

On an IG-worthy restaurant while out-of-town? Purchasing souvenirs from some of the top tourist destinations here? Need extra cash to extend your trip or fuel your shopping spree?

It doesn’t matter whether you pay in cashless or cash. BDO Pay’s got your back with its QR features.

BDO Pay to beat the holiday rush

Furthermore, BDO Pay makes it easier to send money to loved ones, with free BDO-to-BDO transfers and transfers to other banks and wallets at only P10 via InstaPay.

It may be just a quick trip to the local market or nearby. If ever your friends and family run out of cash to use, it’s easy to send them unique QR codes to withdraw on their own via BDO ATMs.

And with the holiday season fast-approaching, leveraging BDO Pay to send QR codes to your godchildren can be a convenient alternative.

Save yourself the hassle of going out during the holiday rush and let them withdraw it at their convenience. You do not only get to avoid stress but it teaches them how to become more financially responsible as well.

Knowing how to leverage QR codes and BDO Pay together will make everything hassle-free and let you focus on being the adventurer you always dreamed of.

This feature is a collaboration between GadgetMatch and BDO Unibank.

Doomscrolling is the greatest enemy to everyone’s productivity today. The temptation to keep on scrolling for hours is an ever-present temptation. Taking a very strong stance against the phenomenon, the European Commission is now investigating TikTok for having an addictive interface.

Via Politico, Brussels is now prodding TikTok to change its interface. Very technically, the European Commission is not out to get doomscrolling, specifically. However, the major changes that they want to introduce “disabling infinite scrolling, setting strict screen time breaks, and changing its recommender systems.”

App addiction is a persistent problem today. Besides concerned parents, governments around the world have been trying to regulate addiction, especially when it comes to children. The European Commission, as is apparent from this new initiative, is at the forefront of preventing addiction.

Though the target is explicitly TikTok right now, changing addictive interfaces will also affect other social media platforms including Facebook, Instagram, and X. Most platforms nowadays thrive on encouraging users to keep scrolling through more content.

Right now, TikTok isn’t set to change just yet. However, the report states that the European Commission is willing to work with platforms for a better, non-addictive interface. It’s less abrasive than the region’s recent privacy initiatives, which requires users to verify their age before accessing mature content.

Apps

Breaking up with Adobe Photoshop after 20 years

Wedding planning and Apple Creator Studio made me realize it was time

Planning a wedding, even a small and intimate one, has a way of sharpening your sense of priorities. Right as my fiancé and I were making decisions for our city hall wedding here in New York City, Apple announced Creator Studio.

Creator Studio is a subscription service that gets you access to eight creative pro and productivity apps for US$12.99 a month, or US$2.99 if you’re a student or educator. The design app included in the subscription, Pixelmator Pro, is also available as a standalone purchase for US$49.99. Adobe Photoshop, my design software of choice for over two decades costs me US$22.99 a month.

Seeing those numbers next to each other made me pause. It’s not that I was unhappy with Photoshop. I was just suddenly made aware how expensive it is. I’d been paying more for a single tool than I could for an entire creative ecosystem.

Creative Studio’s lower price point, along with the free trial, made me consider switching to Pixelmator Pro altogether. That’s something I never thought I would do. Photoshop was how I got into graphic design. It was my first love, and up until recently, I truly thought it would be my ride or die.

Getting to know Pixelmator Pro

If you’re not familiar, Apple’s Pixelmator Pro is a graphic design and image editing app that’s similar to Adobe Photoshop. In practice, it covers a huge amount of the same ground but with a very different philosophy around usability and design.

I tried Pixelmator Pro, mostly as a challenge because we were doing a YouTube video on Apple Creator Studio. Personally, I was lowkey excited to try something new.

The first time I loaded the app, I recreated our YouTube thumbnail template — all within 10 minutes — and I haven’t looked back since.

Familiar enough to feel effortless

One of the biggest reasons my transition to Pixelmator Pro was so easy is muscle memory. Many shortcuts behave the same way: cmd+T for transform, cmd+R to show rulers, cmd+J to duplicate layers, just to name a few.

Having used Photoshop since high school, it felt familiar and intuitive — the complete opposite of how it felt to try and switch to Adobe Illustrator many years ago.

Photoshop is how I got into graphic design. It was my first love, and up until recently, I truly thought it would be my ride or die.

Later, I learned that you can import PSD (Photoshop) files directly to Pixelmator Pro. Apparently I didn’t even need to recreate the GadgetMatch assets. It does a good job of converting and preserving layers.

Photoshop now feels archaic

After using Pixelmator Pro for a few days, going back to Photoshop felt jarring. The sharp edges of the UI felt cold and rigid. Everything was layered with popups, panels, and tiny interruptions.

Pixelmator Pro, in comparison feels warm, smooth and frictionless. Its user interface is very Apple-like — rounded edges, softer icons and buttons. The Creator Studio version also gets the new Liquid Design touch, with transparent menus and elements that feel dynamic.

I especially love the little things. Color adjustments live in one simple panel instead of being scattered across different windows. There’s an eyedropper tool beside every color picker with a magnifier built-in.

When you hover over tools, it shows you the shortcut (e.g. “R” for Repair). There are also subtle animations, like when you use the Color Fill tool to change your canvas color.

The differences in user experience are stark. Photoshop’s animations either don’t exist or are too abrupt for one to notice.

Smart tools without the noise

Photoshop has one clear advantage over Pixelmator Pro: Generative AI. It’s great and powerful especially when you need to save time.

I personally used it a couple of times before to save time on cloning, erasing, or expanding elements. Am I going to miss it with this switch? Something tells me I won’t.

Pixelmator Pro’s clone and repair tools, though seemingly so simple, work like a charm. And for how I usually manipulate images, those two are more than enough.

From digital to physical

If Pixelmator Pro was going to replace Photoshop in my workflow, wedding prep was the perfect time to give it a real world test — and it more than held its own. Its ease of use gave me permission to think outside the box, because I knew I had a reliable tool that can help me make it happen.

On the left, a Kufic-inspired wedding logo designed on Pixelmator Pro; on the right, 3D printed stamps

Since my fiancé is half-Iranian, I designed a logo combining our names, inspired by Kufic calligraphy, and I did it entirely in Pixelmator Pro. I developed that same logo further and designed a save the date, with color, also inspired by Kufic calligraphy. I went through a few iterations to come up with the final designs, which were made easier by the Shape tool and grid overlays.

My fiancé then took the logo I designed in Pixelmator Pro, converted it to 3D on Revit, and printed it into stamps in different sizes. One way we’re using it is to deboss the handmade pottery he’s making as one of our party favors.

There are a few more wedding pieces I’m designing on Pixelmator Pro in the coming weeks: our final invitation, and the custom stationery for the dinner that follows the ceremony.

Through this whole process, Pixelmator Pro never felt like it got in the way, or that it was limited. On the contrary, it feels like that enabler friend who says yes to every idea I have, and can actually help make them real.

Powerful, but approachable

The best way I can describe what using Pixelmator Pro is like is this: it’s a mix of Photoshop’s professional tools, Canva’s free library of assets, and Apple’s UI sensibility.

Shortly after Apple announced Creator Studio, Adobe rolled out significant Creative Cloud discounts. Are they threatened? They better be.

That makes it great for beginners, small business owners, and casual creators. Like Canva, it comes with some beautiful templates to help someone with zero experience come up with something good.

But unlike Canva, it still feels like a serious design tool. I can do so much of what I need using Pixelmator Pro but with UI that’s so much more approachable compared to Photoshop.

I remember meeting Canva’s founders before launch and not fully understanding their mission to make graphic design accessible to everyone. Now I do.

It was never about replacing Adobe products and pro designers. What Canva did was fill a huge void we didn’t know existed. They democratized something that used to be reserved only for the privileged few.

Pixelmator Pro comes with free templates, assets, and mockups like this MacBook Pro and coffee packaging

Pixelmator Pro’s lower barrier to entry has potential to make a significant impact. My hope is it opens doors for people who were previously shut out of the graphic design world, and that it becomes something they can grow with, just as I did with Photoshop.

Adobe is still the industry standard

Switching to Pixelmator Pro wasn’t about rejecting Adobe, in the same way that Canva’s success did not kill Photoshop.

It’s worth noting that Adobe products are still the standard in the industry. A lot of companies rely on them, and most schools teach them. In a traditional design or agency environment, Photoshop and Illustrator are still the default language.

Even on Apple’s own Design Resources site for developers, the official design templates are built for Adobe Photoshop and Illustrator, not Pixelmator Pro. That says a lot about how embedded Adobe is in professional workflows.

Competition makes the space better

Apple Creator Studio, and tools like Pixelmator Pro, challenge Adobe’s near-monopoly in a really healthy way.

It’s not lost on me that trading Photoshop with Apple software actually keeps me locked into one ecosystem. But having more pro creatives try Pixelmator Pro can put pressure on the industry. A strong alternative that’s more cost effective can force titans and dinosaurs to evolve in a way the likes of Corel was never able to do.

Ideally, that means better products and fairer pricing for everyone. Shortly after Apple announced Creator Studio, Adobe rolled out significant Creative Cloud discounts. Are they threatened? They better be.

Access matters, and at the end of the day, with a healthy competition in the market, it’s consumers that win. Canva is a great example of this. It made design tools accessible to those who aren’t professionals. It didn’t make everyone a great designer, just as a novice who tries Final Cut Pro today won’t become a pro video editor tomorrow. Design is still a craft you develop over time with practice.

Is Pixelmator Pro my GadgetMatch?

Photoshop still has its place. But for my everyday work, and occasional personal projects, Pixelmator Pro can do everything that I need to accomplish, at a fraction of the cost.

It feels faster, lighter, and more alive. Honestly learning my way around new software has been so enjoyable — so much so that I feel a renewed sense of eagerness to try other design software like Blender and Figma.

Pixelmator Pro never felt like it got in the way, or that it was limited. On the contrary, it feels like that enabler friend who says yes to every idea I have, and can actually help make them real.

Wedding planning and Apple Creator Studio didn’t just make me switch to a new software. They also made me question how much I’ve been missing out on. How much of what I do is simply due to inertia?

Ending my longest relationship doesn’t mean it failed. I’m grateful for what Photoshop taught me. It helped shape the creative professional that I am today.

But alas, this is one area where my practicality wins over loyalty. Relationships — with people or with tools — only work when both parties keep showing up. There’s no room for complacency, despite the history.

Walking away from something that taught me so much feels bittersweet, but Pixelmator Pro fits the way I work now, and I hope it grows with me as I turn the next page.

Apps

Apple Creator Studio: Creative apps bundled into single subscription

All the tools you need, one payment

Apple has officially streamlined its popular creative apps into one single subscription suite with the introduction of Apple Creator Studio.

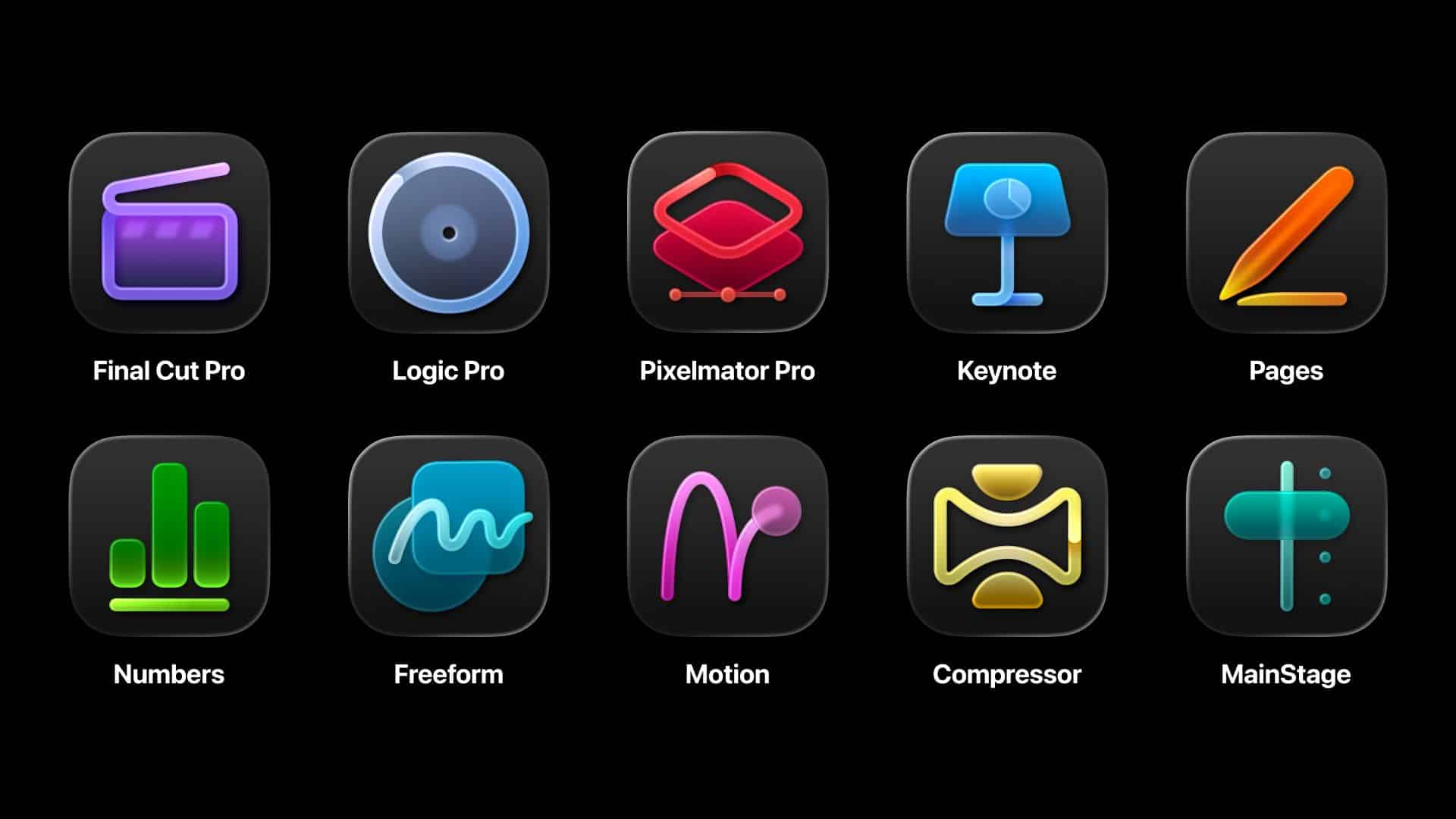

The collection includes some of the most useful apps for today’s creators: Final Cut Pro, Logic Pro, Pixelmator Pro, Motion, Compressor, and MainStage.

New AI features and premium content in Keynote, Pages, and Numbers also make the Apple Creator Studio an exciting subscription suite. Freeform will eventually be added to the lineup.

The groundbreaking collection is designed to put studio-grade power into the hands of everyone. It builds on the essential role Apple devices play in the lives of millions of creators worldwide.

The apps included cover video editing, music making, creative imaging, and visual productivity to give modern creators the features and capabilities they need.

Final Cut Pro introduces exceptional new video editing tools and intelligent features for Mac and iPad.

For the first time, Pixelmator Pro is also coming to iPad with a uniquely crafted experience optimized for touch and Apple Pencil.

Logic Pro, meanwhile, for Mac and iPad introduces more intelligent features like Synth Player and Chord ID.

Apple Creator Studio will be available on the App Store beginning January 29. In the Philippines, the rates are PhP 399 a month or PhP 3,990 annually.

There is also a free one-month trial which includes access to:

- Final Cut Pro, Logic Pro, and Pixelmator Pro on Mac and iPad

- Motion, Compressor, and MainStage on Mac

- Intelligent features and premium content for Keynote, Pages, Numbers, and later Freeform for iPhone, iPad, and Mac

College students and educators can subscribe for a discounted price of PhP 149 per month or PhP 1,490 per year.

-

News2 days ago

News2 days agoXiaomi 17 Ultra is now available outside China

-

Camera Walkthrough1 week ago

Camera Walkthrough1 week agoOPPO Reno15 Pro: Camera Review

-

First Look2 weeks ago

First Look2 weeks agoMatch Pulse: Infinix NOTE 60 Pro

-

Cameras2 weeks ago

Cameras2 weeks agoOsmo Pocket 4 makes a surprising appearance in public

-

Gaming2 weeks ago

Gaming2 weeks agoLG unveils UltraGear evo, redefines 5K gaming with AI Upscaling

-

News2 weeks ago

News2 weeks agoiPhone 17 Pro Max is somehow the most traded-in phone today

-

News2 weeks ago

News2 weeks agoHUAWEI launches Mate X7, MatePad 11.5 S 2026, FreeClip 2

-

Gaming2 weeks ago

Gaming2 weeks agoPlayStation 6 reportedly delayed to 2029 because of RAM shortage