Apps

Replay! Apple Music launches new year-end experience

2022 Top Charts revealed

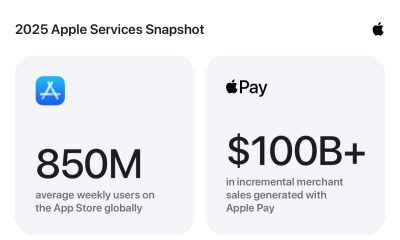

So, what have you been listening to an Apple Music in 2022? The redesigned Apple Music Replay experience will let you know what you’ve bopping to this year.

Apple Music Replay recaps what users listened to the past year. But new in 2022 is a year-end experience complete with expanded listening insights and new functionality. This includes a personalized highlight reel.

Users can discover their top songs, top albums, top artists, top genres, and more. Superfans can even discover whether they are in the top 100 listeners of their favourite artist or genre.

Apple Music listeners can continue checking Replay until December 31 and once the new year begins, keep listening on Apple Music to explore and share new 2023 insights each week.

All insights on Replay are optimized for sharing on socials or on any messaging platform.

How Apple Music Replay Works

Visit replay.music.apple.com and log in with the same Apple ID used for Apple Music. Play highlights or scroll through the page for more detailed insights. A truncated version of the site is available all year or as soon as a user is eligible.1

How to See Listening Stats

- Listen to enough music to qualify. Gauge qualification with a personalised progress bar on the Replay website. Both playlist and insights eligibility happens with the same listening threshold.

- Once a user is eligible for Replay, they can visit replay.music.apple.com.

- Explore listening stats, listen on the site, and share.

Replay is localised in 39 languages for all 169 countries and regions where Apple Music is available.

Top Charts 2022

Apple Music also revealed its year-end charts, spotlighting 2022’s top songs, top Shazams, top fitness songs, and most-read lyrics. Apple also shared a list of the most Shazamed K-Pop songs in 2022.

Top Songs of 2022: Singapore

Top Shazamed Songs of 2022: Singapore

Singapore: Top K-Pop Songs Shazamed

Apps

Apple Creator Studio: Creative apps bundled into single subscription

All the tools you need, one payment

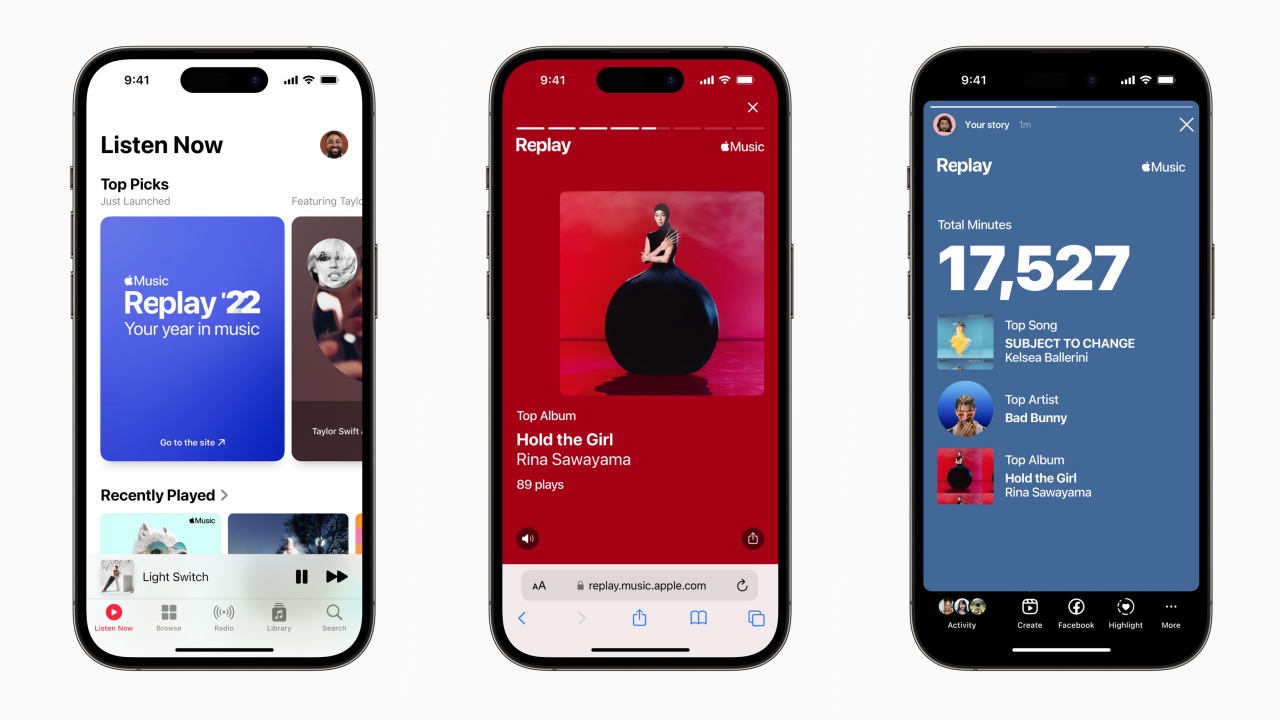

Apple has officially streamlined its popular creative apps into one single subscription suite with the introduction of Apple Creator Studio.

The collection includes some of the most useful apps for today’s creators: Final Cut Pro, Logic Pro, Pixelmator Pro, Motion, Compressor, and MainStage.

New AI features and premium content in Keynote, Pages, and Numbers also make the Apple Creator Studio an exciting subscription suite. Freeform will eventually be added to the lineup.

The groundbreaking collection is designed to put studio-grade power into the hands of everyone. It builds on the essential role Apple devices play in the lives of millions of creators worldwide.

The apps included cover video editing, music making, creative imaging, and visual productivity to give modern creators the features and capabilities they need.

Final Cut Pro introduces exceptional new video editing tools and intelligent features for Mac and iPad.

For the first time, Pixelmator Pro is also coming to iPad with a uniquely crafted experience optimized for touch and Apple Pencil.

Logic Pro, meanwhile, for Mac and iPad introduces more intelligent features like Synth Player and Chord ID.

Apple Creator Studio will be available on the App Store beginning January 29. In the Philippines, the rates are PhP 399 a month or PhP 3,990 annually.

There is also a free one-month trial which includes access to:

- Final Cut Pro, Logic Pro, and Pixelmator Pro on Mac and iPad

- Motion, Compressor, and MainStage on Mac

- Intelligent features and premium content for Keynote, Pages, Numbers, and later Freeform for iPhone, iPad, and Mac

College students and educators can subscribe for a discounted price of PhP 149 per month or PhP 1,490 per year.

Apps

Apple gives up on making AI, inks a deal with Gemini to power Siri

Gemini gets another feather in its cap.

In the not-too-long-ago past, the biggest names of the tech industry competed to build their own AI software. Now, though some brands are still on the hunt, it’s easier to name certain software that have more successfully drowned users in a flood of AI-powered features. Today, Google gets another win by adding Apple’s Siri to its Gemini cap.

In the past, Apple peddled Apple Intelligence, an upcoming AI-powered system to compete against the giants of the industry. However, much like other features from other brands, Apple Intelligence came out half baked with features still lacking months after the initial launch.

Now, Apple has signed a deal with Google to use Gemini for a revamped Siri. The former plans to launch a new version of Siri later this year. Because of the deal, the voice assistant will start using Gemini as a foundation for its own services. Currently, Samsung’s Galaxy AI already uses Gemini.

Formerly a battleground between so many competing brands, it’s now looking like a battle between two major companies: Google and OpenAI. Google now has a huge grip, though. Both Samsung and Apple are no slouches when it comes to owning market share in the world’s smartphones.

Now, as consumers, Apple’s deal probably doesn’t mean much besides the continued influx of features that add little to no value to a smartphone.

SEE ALSO: Google paid Samsung a lot of money to install Gemini on Galaxy

Apps

Microsoft continues to shove Copilot where it’s not wanted

This time, it’s reportedly coming to File Explorer.

If you look at a modern keyboard, you’ll find that the Copilot button is the cleanest one on the entire panel because no one ever willingly presses it. And yet, Microsoft still believes in the feature’s value. To show their odd commitment, the company is reportedly adding Copilot to File Explorer.

According to @phantomofearth from X (via Windows Central), a new Windows 11 preview build will add a button beside File Explorer’s navigation menu. Currently, the button is invisible and doesn’t do anything. However, the report says that the feature is tied to something called “Chat with Copilot.” It’s becoming clear that the system aims to add the AI software right inside the file organization app.

Besides revealing the potential addition of the egregious feature inside File Explorer, @phantomofearth also added mock-ups of a desktop with Copilot right on the taskbar, hinting at a potential nightmare of the feature lording itself over where it’s not wanted.

Thankfully, the preview build doesn’t always represent a final version of the system. There’s still a chance that Microsoft will not add the AI to the File Explorer.

As of late, Microsoft has received a lot of flak for persistently pushing Copilot onto users, regardless of how they feel about the feature. The company is also facing criticisms in the background for being a major proponent of AI data centers in the United States, which, in turn, have caused the prices of tech to skyrocket this year.

SEE ALSO: Dell admits AI PCs were a mistake

-

News2 weeks ago

News2 weeks agoInfinix NOTE Edge debuts: High-end features for accessible pricing

-

Reviews1 week ago

Reviews1 week agoHONOR X9d 5G review: Tougher, more long-lasting and optimized

-

Automotive1 week ago

Automotive1 week agoBYD expands PH presence with entry of DENZA luxury EVs

-

News2 weeks ago

News2 weeks agoHONOR slaps the iPhone Air with the all-new Magic8 Pro Air

-

News1 week ago

News1 week agoBeyond the Box, Digital Walker turn over Tesla Model Y to iPhone 17 raffle winner

-

Gaming1 week ago

Gaming1 week agoNow playing: Final Fantasy VII Remake INTERGRADE on Switch 2

-

Accessories1 week ago

Accessories1 week agoRazer fully unwraps these limited BLACKPINK Edition gaming gear

-

Accessories1 week ago

Accessories1 week agoG-DRAGON is CASETiFY’s first ever Global Brand Ambassador