Enterprise

These are the new top vendors in the world’s biggest smartphone market

Despite a booming Indian market dripping with potential and promise, China remains the world’s biggest buyer of smartphones. And according to a new study, it has two new vendors that reign at the top of the smartphone pack.

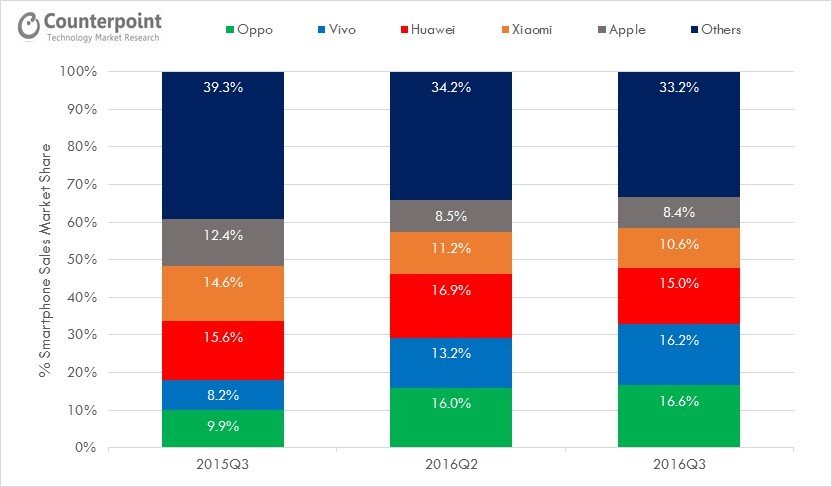

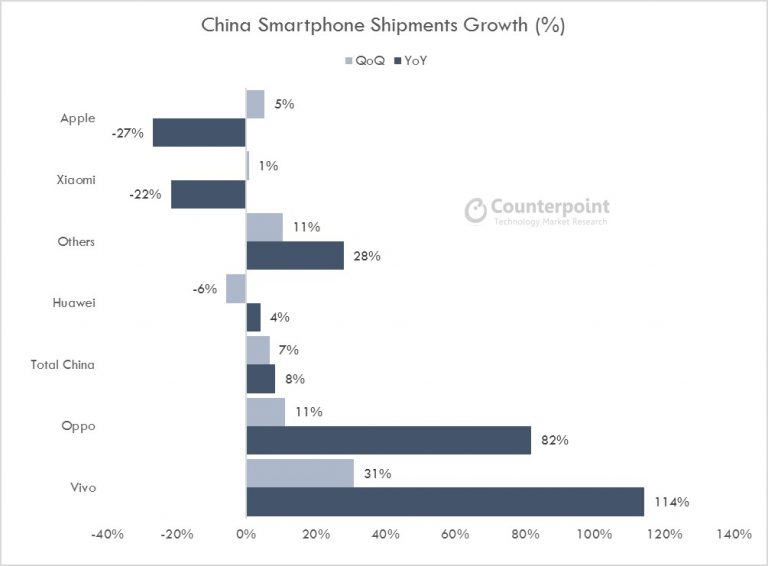

The most recent data from analyst firm Counterpoint Research show that OPPO and Vivo have pulled ahead of the rest of the competition in their native China after recording a sales growth of 0.6 percent and 3 percent, respectively, over the previous quarter.

From July to September of this year, OPPO accounted for 16.6 percent of smartphones sold in the Far East, good enough for the top spot overall. Vivo, meanwhile, ranked a close second with 16.2 percent of market share. Huawei and Xiaomi claimed the third and fourth spots, following a slight dip in the third quarter. Apple came in at number five.

[irp posts=”7067″ name=”OPPO R9s, R9s Plus with 16MP rear and front cameras break cover in China”]

Counterpoint Research noted that OPPO’s R9 midrange smartphone dominated sales in China from July through September, eclipsing the iPhone, while Vivo owed its impressive quarter to the X7 and X7 Plus. The firm also said that:

‘The focus on traditional offline retail and wider distribution network which still constitutes three-fourth of smartphone demand has been key to OPPO and Vivo success.’

None of the devices are particularly compelling from a technical aspect; they’re upper-midrange offerings at best. It’s also worth mentioning that OPPO and Vivo (and OnePlus) are subsidiaries of BBK Electronics, which somewhat explains why some of their devices look so much alike.

Xiaomi’s sluggish performance in familiar territory has been pinned on its online-centric business model, which has “hit a ceiling.” Still, Xiaomi and Huawei have the rest of the year to regain some lost ground, especially as both brands are slated to launch their respective flagships in China sometime in November or December. We hear the Mi Mix is looking to be a “must have.”

[irp posts=”5061″ name=”Vivo Y55L budget smartphone gets announced in India”]

Source: Counterpoint Research via Android Authority

For the longest time, Google kept Pixel and Android behind two different teams. While the Pixel team dealt with devices made by and for the brand, the Android team ships a product meant for brands outside of the company’s purview. However, the days of separation are at an end. Google is officially merging its Pixel and Android teams together.

In a shocking announcement, the company has confirmed that the teams handling hardware and software will fall under a single team headed by Rick Osterloh. Prior to the merge, Osterloh was the senior vice president of devices and service, which was Google’s hardware branch. He will now oversee both hardware and software.

Because of the new leadership change, Hiroshi Lockheimer, former head of Android, will now move on to other projects within Alphabet. Of note, the change is not harsh for Lockheimer. He and Osterloh had been contemplating on the merge for a while.

Now, why the change? As is the case with everything today, it’s all because of AI. Speaking to The Verge, Osterloh explains that the merge will help with “full-stack innovation.” With how technology is these days, it’s now impossible to develop AI without having a close eye on hardware, such as in Google’s AI developments for the Pixel camera. Merging the teams will help streamline development, especially when hardware is involved.

Despite the change, outside brands, like Qualcomm’s Cristiano Amon, remains confident of Android’s capabilities outside of Google. Just expect more AI coming out in the near future.

The ongoing trade war between the United States and China is putting a lot of companies out of business in one country. While all eyes are currently on America’s crusade against TikTok, China has launched a salvo of its own. The country has started banning AMD and Intel, starting with government devices.

Recently, as reported by the Financial Times, China has introduced a new rule that bans American chipsets and servers from government agencies. The new ban includes AMD, Intel, and Microsoft Windows.

In lieu of the now-banned brands, Chinese government agencies must use approved brands from a list of 18 Chinese manufacturers. Unsurprisingly, the list includes Huawei, another brand involved in the ongoing trade war. (Huawei is still banned on American soil.)

As with bans from America, China’s latest rules stem from a desire to implement national security. Both countries allege that using brands from the opposing side will open a potential avenue for transferring classified information.

Currently, the ban against the American chipsets are only affecting government devices. However, if it follows the same trajectory as Huawei and TikTok in the United States, a government-only ban might soon lead to an all-out ban on consumer devices. As TikTok is currently hanging in the balance, it’s unlikely that the trade wars will cool down anytime soon.

So far, Apple’s greatest enemy has been the European Union. Months and months of claiming that the company engages in anti-competitive practices, the region has successfully caused Apple to drastically change a lot of things about the iPhone including the Lightning cable. Now, a new challenger wants Apple to answer for its supposed grip on the industry: the United States government.

Today, the Department of Justice is officially suing Apple for supposedly monopolizing the smartphone industry and stifling competition. The lawsuit alleges that Apple’s lineup of products prevent users from trying out other brands. For example, Apple limits how well a third-party smartwatch works on an iPhone, pushing users to go for an Apple Watch instead.

The lawsuit also includes an important pain point in Apple’s fight in Europe. It says that the company makes it difficult for iPhone users to communicate with Android users (and vice versa). Late last year, the company already committed to supporting RCS as a messaging standard, finally easing communication between the two systems. Their adoption has yet to arrive, though.

Though not as stringent as Europe, the American government is no slouch when it comes to questioning its own companies for pursuing anti-competitive practices. In the past, it went through Google and Spotify to protect the interests of its citizens. The lawsuit against Apple is no different, gathering signatures from sixteen states.

For Apple’s part, the company aims to get the case dismissed, alleging the lawsuit’s unfair scope of just the American people when it targets the entire world.

SEE ALSO: Apple opens first Developer Center in Southeast Asia

-

Reviews7 days ago

Reviews7 days agorealme 12 5G review: It was enchanting to meet you

-

Buyer's Guide2 weeks ago

Buyer's Guide2 weeks ago2024 Samsung TV: Buyer’s Guide

-

Reviews2 weeks ago

Reviews2 weeks agoJBL Soundgear Sense review: Make every run magical

-

Reviews3 days ago

Reviews3 days agoOnePlus 12R review: Making sense of OnePlus’ latest flagship

-

Smartphones2 days ago

Smartphones2 days agoHuawei Pura 70 Pro Unboxing and First Impressions

-

Reviews2 weeks ago

Reviews2 weeks agoChallengers review: A thrilling drama wrapped as a tennis anime

-

News1 week ago

News1 week agoXiaomi Redmi A3 Philippine pricing, availability

-

Smartphones1 week ago

Smartphones1 week agoInfinix NOTE 40 Pro+ 5G: Philippine pricing, availability