Enterprise

Apple is now worth $2 trillion

The first American company to do so

Apple hit a market cap of US$ 2 trillion today after doubling in valuation in just over two years. The iPhone maker is the first American company to reach that milestone.

The most surprising part is, most of the momentum came in just a few months ago. Markets crashed globally in March due to the Coronavirus pandemic, but recovery has been extremely quick and the US’ NASDAQ 100 index is already hovering around an all-time high.

While a plethora of industries have taken a radical hit due to the pandemic, technology companies are leading the bullish wave. On July 31, Apple surpassed oil giant Saudi Aramco to become the world’s most valuable publicly-traded company.

Apple was an almost bankrupt company in 1997. In the last two decades, the company has grown rapidly thanks to cutting-edge innovation. The Cupertino giant went on to revolutionize the music industry with iPod and iTunes.

The portable music player became a cultural icon, making way for the iPhone. Apple’s iPhone is often credited for single-handedly dethroning leaders like BlackBerry and Nokia. Further evolving its lineup, the company went on to make the Apple Watch.

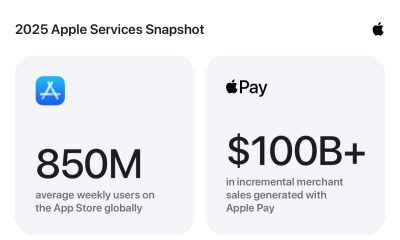

Today, it controls an ecosystem comprising of the iPhone, iPad, Apple Watch, Mac, and more. While the company continues to rely on hardware sales as its primary revenue source, services like Apple Music and Apple Arcade have received positive feedback. This opens another door of secondary revenues for the company.

However, the timing of the milestone is intriguing because the company is being investigated for having too much control. Antitrust hearings are ongoing and many in the Senate want to split up big tech companies. However, Apple isn’t the only one who’s valuation is consistently rising amid the pandemic. The stock of Microsoft, Facebook, and Google has also witnessed a wave of bullish investments.

Enterprise

realme is reportedly going back to being an OPPO sub-brand

All scheduled phones will still launch on time, though.

A popular story among Chinese smartphone brands is whenever a sub-brand spinning off into its own independent entity. A less common one is when an independent entity suddenly merges back into the main entity. And yet, that’s the story we have today. realme is reportedly going back to being a sub-brand of OPPO.

If you don’t remember realme’s time as a sub-brand, then it’s hardly your fault. It’s been a long while since realme was considered a sub-brand. In 2018, the brand spun off on its own to form one of the most popular names in the Chinese smartphone space.

Today, via Leiphone, realme will return to OPPO as a sub-brand. Current realme CEO Sky Li will still retain his responsibilities heading the brand. Plus, all products on the current release schedule will still come out as planned.

However, starting this year, realme will start reintegrating back into OPPO, particularly through the latter’s after-sales programs. OnePlus will also follow the same structure going forward.

Currently, realme has not officially announced the move. That said, we also don’t know how the brand will address the reported change. It’s possible that the shift is just internal and has no effect on how the brand faces the public. For now, only time will tell.

SEE ALSO: realme C85 with 7000mAh battery, 5G connectivity officially launches

The big story late last year was the skyrocketing prices of chips. Analysts are predicting that the demand for RAM will cause the entire industry to experience hikes this year. Some users, especially in the PC building scene, are already feeling the burn. PCs won’t be the only victims, though. Xiaomi is already expecting hikes across the board. Now, Samsung is adding its voice to the growing list of warnings about price increases.

During CES 2026, Wonjiun Lee, Samsung’s global marketing chief, confirmed that the memory shortages are, in fact, real (via Bloomberg). Moreover, the company is now evaluating whether more price hikes are needed this year for its products. Though Lee expressed regret over pushing the prices to consumers, the state of the industry might force the company’s hand.

Samsung’s opinion has a lot of weight. While other brands have also voiced out their opinions lately, Samsung itself is a producer of chips. If a chip supplier is already warning users of prices affecting them, the effect will likely cascade even more when it comes to device manufacturers.

The ongoing shortage of chips is a result of the overwhelming demand from companies looking to build and bolster AI-based servers. The business-to-business demand is notably different from how regular consumers, who will soon find it hard to buy their own devices, see it.

At the very least, Samsung has not confirmed any price increases yet. However, all eyes are on the next Galaxy Unpacked, when Samsung will launch its newest Galaxy products. Will prices increase or stay the same?

Enterprise

TikTok finally gets a buyer in the United States

The deal targets a closing date in late January.

The year started with a ban. A day before Donald Trump started his second term, TikTok went dark, in anticipation of an impending ban. The platform quickly went back online, leading to an ultimatum that saw TikTok hunt for an American buyer to full stave off a definitive ban in the United States. Now, as the year ends, a buyer is finally here.

Via CNBC, TikTok has reportedly inked a deal to finalize a deal in the United States, as stated in an internal memo from CEO Shou Zi Chew. The memo, which was sent just this week, details a plan that will see the deal close by January 26, 2026.

Fifty percent of TikTok’s newly restructured U.S. arm will be held by a collection of American investors including Oracle, Silver Lake, and MGX. Meanwhile, already existing investors of TikTok will hold 30.1 percent. Finally, ByteDance will retain 19.9 percent.

Additionally, TikTok’s algorithm in the United States will be retrained with American data. The American arm will also handle the country’s “data protection, algorithm security, content moderation, and software assurance.” Oracle will be the “trusted security partner” in charge of making sure the company keeps within regulations in the country.

With a deal pushing through, the long-running TikTok saga in the United States might finally come to a close.

-

News1 week ago

News1 week agoInfinix NOTE Edge debuts: High-end features for accessible pricing

-

Reviews2 weeks ago

Reviews2 weeks agoRedmi Note 15 Pro+ 5G review: The midrange fashion piece

-

Reviews2 weeks ago

Reviews2 weeks agoMijia Smart Audio Glasses review: Immerse yourself in the music

-

Features2 weeks ago

Features2 weeks agoCan the REDMI Note 15 Pro+ 5G Survive?

-

News2 weeks ago

News2 weeks agoREDMI Note 15 Series unveiled: Price, availability in the Philippines

-

Reviews7 days ago

Reviews7 days agoHONOR X9d 5G review: Tougher, more long-lasting and optimized

-

Gaming2 weeks ago

Gaming2 weeks agoCivilization VII coming to Apple Arcade this February 5th

-

News2 weeks ago

News2 weeks agoTwo new Xiaomi audio wearables join REDMI Note 15 Series