Enterprise

Philippines wants to tax Netflix, Spotify to increase coronavirus relief funds

Might add 12 percent to current prices

After two months of community lockdowns, the Philippines’s response to the pandemic remains controversial at best. At the time of publishing, the country has 14,035 confirmed cases of COVID-19 and 868 deaths.

Recently, Congressman Joey Salceda, currently chairing the Committee on Ways and Means, has proposed a new tax aimed against the country’s biggest social media and entertainment platforms: Facebook, Google, Netflix, YouTube, and Spotify.

Currently, the globally recognized companies are not taxed for putting up ads for goods on online marketplaces in the Philippines. Meanwhile, other entities still pay the 12 percent value-added tax.

As reported by Reuters, the proposed tax will siphon more funds into the country’s pandemic response, including a “national broadband project and digital learning [programs].” However, the bill’s provisions are not available to the public yet.

According to the Philippine Daily Inquirer, the tax is against both currently untaxed advertising and services. For merchants selling goods and advertising online, “only 50 percent… pay VAT.” Further, Salceda proposes that digital advertising, especially those done by foreign companies, must course through an official country representative.

For services, Salceda suggest an additional 12-percent tax on entertainment subscriptions. However, a big question lies on who will ultimately carry the blow of the new tax. Is it the company itself or the consumers through higher subscription fees? Right now, Netflix and Spotify subscriptions are slightly lower than their American counterparts. Netflix Philippines has declined to comment.

However, as a bill is still just a bill, no one knows if and when the new tax will push through.

SEE ALSO: Netflix is raising $1 billion to create more original content

Enterprise

TikTok finally gets a buyer in the United States

The deal targets a closing date in late January.

The year started with a ban. A day before Donald Trump started his second term, TikTok went dark, in anticipation of an impending ban. The platform quickly went back online, leading to an ultimatum that saw TikTok hunt for an American buyer to full stave off a definitive ban in the United States. Now, as the year ends, a buyer is finally here.

Via CNBC, TikTok has reportedly inked a deal to finalize a deal in the United States, as stated in an internal memo from CEO Shou Zi Chew. The memo, which was sent just this week, details a plan that will see the deal close by January 26, 2026.

Fifty percent of TikTok’s newly restructured U.S. arm will be held by a collection of American investors including Oracle, Silver Lake, and MGX. Meanwhile, already existing investors of TikTok will hold 30.1 percent. Finally, ByteDance will retain 19.9 percent.

Additionally, TikTok’s algorithm in the United States will be retrained with American data. The American arm will also handle the country’s “data protection, algorithm security, content moderation, and software assurance.” Oracle will be the “trusted security partner” in charge of making sure the company keeps within regulations in the country.

With a deal pushing through, the long-running TikTok saga in the United States might finally come to a close.

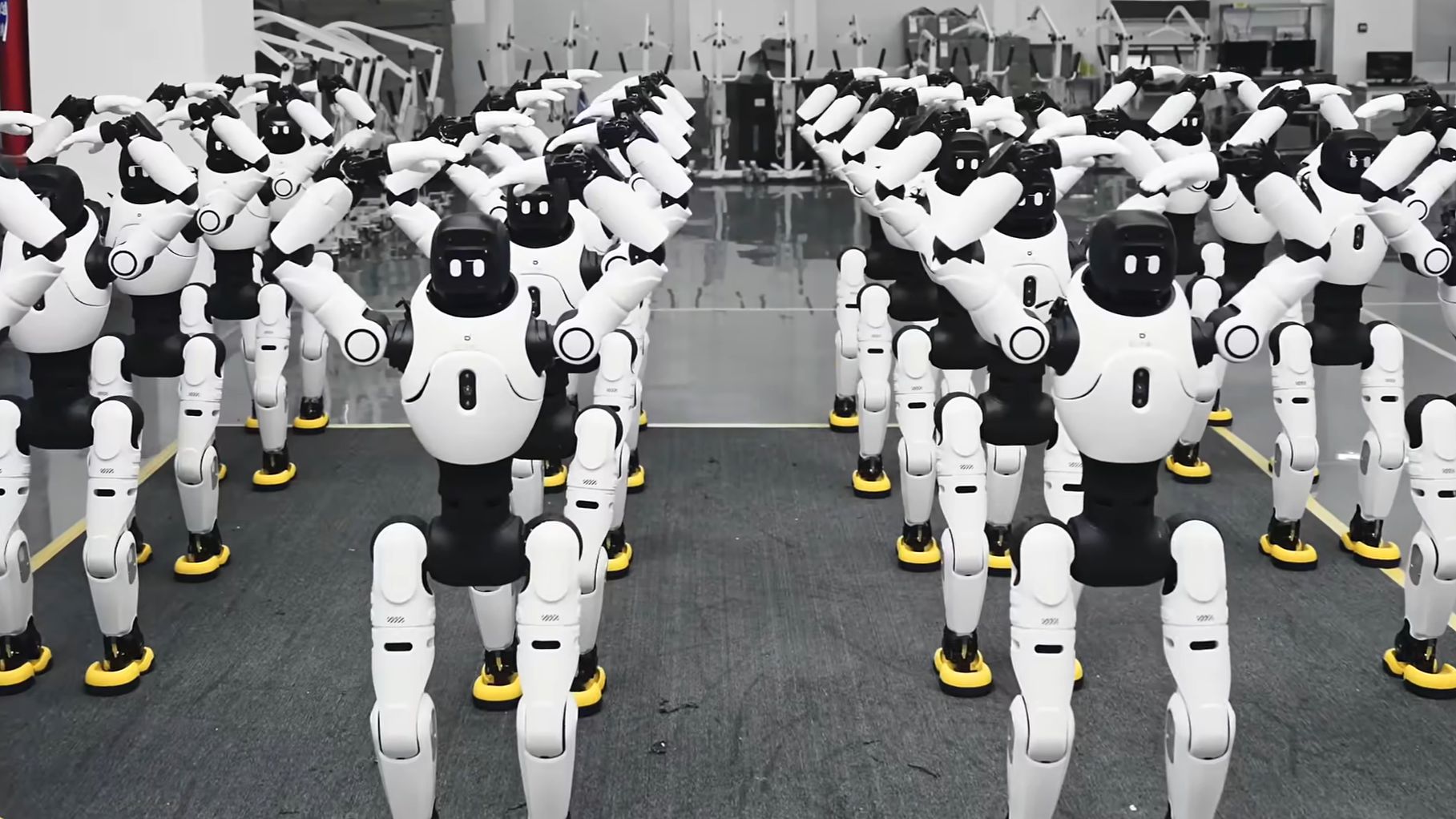

AgiBot has reached a milestone after the Shanghai, China-based robotics company rolled out its 5000th humanoid robot.

The milestone represents a step forward in AgiBot’s ongoing efforts to improve the mass production and practical use of embodied robotics.

AgiBot specializes in the development, mass production, and commercial deployment of such robots which have AI integrated onto them.

These robots are deployed across a wide range of commercial scenarios, including production lines, logistics sorting, security, education, and even entertainment purposes.

To date, the full-size embodied robot AgiBot A-Series has achieved mass production with 1,742 units. Meanwhile, the AgiBot X-Series, an agile half-size robot, has reached 1,846 units.

Lastly, the task-optimized AgiBot G-Series, designed for more complex operations, has reached 1,412 units.

Through widespread adoption across multiple industries, AgiBot is demonstrating the potential of embodied AI to drive industrial upgrades, transform service and production processes, and support broader digitization efforts.

Just recently, AgiBot has successfully deployed its Real-World Reinforcement Learning (RW-RL) system on a pilot production line with Longcheer Technology.

AgiBot’s RW-RL system addresses pain points in production lines such as relying on rigid automation systems. The robots learn and adapt directly on the factory floor.

And in just minutes, robots can acquire new skills, achieve stable deployment, and maintain long-term performance without degradation.

In addition, the system also autonomously compensates for common variations such as part position and tolerance shifts.

Enterprise

Paramount just made a $108-billion counteroffer for Warner Bros.

Netflix’s offer is just for $82 billion.

Late last week, “Netflix bought Warner Bros.” was a sentence often bandied around. The truth was, as always, far less glamorous. Netflix hasn’t bought the entertainment giant just yet. Rather, it just extended a lucrative offer, which gives other suitors and regulating agencies a chance to respond. And respond, they have. Paramount has just made a sizable counteroffer for Warner Bros. Discovery, totalling US$ 108.4 billion in value.

Much like last week’s report, the wording is crucial here. Netflix made an offer for Warner Bros. Paramount is making an offer for Warner Bros. Discovery.

Netflix’s offer of US$ 82.7 billion (or US$ 27.75 per share) hinges on Warner Bros. Discovery un-merging and forming two separate entities: the Warner Bros. arm and the Discovery arm. Netflix plans to buy the former, while the latter (along with its associated networks) will be free to break off into its own ventures. Should it be approved, the deal will be inked only starting around the latter half of next year.

On the other hand, Paramount wants everything, including the cable networks. It’s willing to pay US$ 30 per share, or US$ 108.4 billion.

The company counters that Netflix’s offer is “based on an illusory prospective valuation of Global Networks that is unsupported by the business fundamentals and encumbered by high levels of financial leverage assigned to the entity.”

The company further says that their previous six bids were never seriously considered by Warner Bros. Discovery, whereas the latter reached a unanimous decision with Netflix.

In terms of value, Paramount promises a combination of Paramount+ and HBO Max, as well as an infusion of sports like the NFL and the Olympics.

Though Paramount’s price is much higher than Netflix, it must also go through an approval process. It will expire on January 8, 2026.

-

Accessories1 week ago

Accessories1 week agoKingston launches Dual Portable SSD with up to 2TB storage

-

Gaming1 week ago

Gaming1 week agoExpedition 33 cleans house at The Game Awards: full list of winners

-

Editors' Choice4 days ago

Editors' Choice4 days agoBest Premium Smartphones of 2025

-

Reviews1 week ago

Reviews1 week agoHow the Samsung Galaxy Z Flip7 fit the life I built from the ground up

-

Deals2 weeks ago

Deals2 weeks ago12.12 PH top picks: OPPO, Infinix, Xiaomi, Dyson, Laifen, more

-

News2 weeks ago

News2 weeks agoOPPO Find X9 now available through Smart Postpaid, Infinity

-

News2 weeks ago

News2 weeks agoGoogle Year in Search 2025: NBA Finals, Halalan, Dionela, Alex Eala, more

-

Gaming2 weeks ago

Gaming2 weeks agoGenshin Impact, Duolingo partner for limited-time quest