Enterprise

US revoked Huawei’s remaining licenses

Including Intel’s

Throughout the Trump presidency, Huawei has seesawed between near-extinction and salvation, between bans and temporary pardons. However, in the final days of his reign, Trump is seemingly intent on burning as much bridges as it can. Despite previously granted applications, the U.S. government has revoked Huawei’s remaining licenses, including Intel’s.

Late last year, Intel finally received one of the coveted operating licenses from the government. Amid the expansive ban against Huawei, the chipmaker gained permission to continue doing business with the Chinese company. The company joined a select group which reportedly includes Samsung and Qualcomm. After all, the government promised licenses once companies started applying.

Unfortunately, the government’s sudden turnaround is no surprise. A few days ago, Trump also blacklisted Xiaomi, dumping the company in the same mire as Huawei. Given the events of the past few weeks, the Trump administration is apparently hellbent on causing as much damage as possible.

According to Reuters, eight licenses were revoked from four companies. Besides Intel, memory chip maker Kioxia, formerly known under Toshiba, is reportedly part of the list. Additionally, the government intends to deny several applications in the coming days.

On the bright side, the Trump administration only has a few days left at the time of this writing. Though incoming president Joe Biden’s China-related policies are still an unknown, they will likely be less hostile than Trump’s ongoing policies.

SEE ALSO: Huawei buys 90 patents from BlackBerry

Enterprise

TikTok finally gets a buyer in the United States

The deal targets a closing date in late January.

The year started with a ban. A day before Donald Trump started his second term, TikTok went dark, in anticipation of an impending ban. The platform quickly went back online, leading to an ultimatum that saw TikTok hunt for an American buyer to full stave off a definitive ban in the United States. Now, as the year ends, a buyer is finally here.

Via CNBC, TikTok has reportedly inked a deal to finalize a deal in the United States, as stated in an internal memo from CEO Shou Zi Chew. The memo, which was sent just this week, details a plan that will see the deal close by January 26, 2026.

Fifty percent of TikTok’s newly restructured U.S. arm will be held by a collection of American investors including Oracle, Silver Lake, and MGX. Meanwhile, already existing investors of TikTok will hold 30.1 percent. Finally, ByteDance will retain 19.9 percent.

Additionally, TikTok’s algorithm in the United States will be retrained with American data. The American arm will also handle the country’s “data protection, algorithm security, content moderation, and software assurance.” Oracle will be the “trusted security partner” in charge of making sure the company keeps within regulations in the country.

With a deal pushing through, the long-running TikTok saga in the United States might finally come to a close.

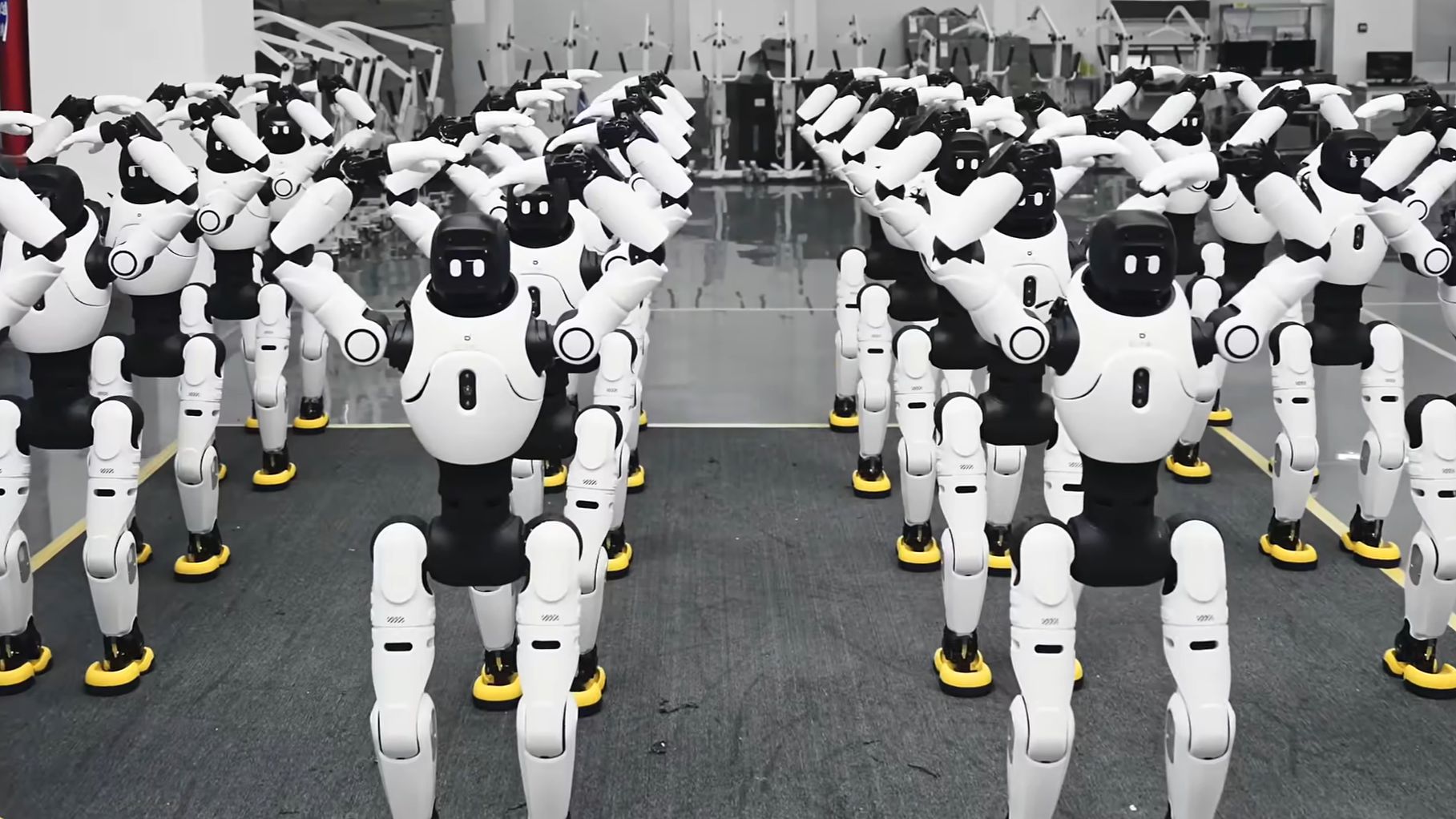

AgiBot has reached a milestone after the Shanghai, China-based robotics company rolled out its 5000th humanoid robot.

The milestone represents a step forward in AgiBot’s ongoing efforts to improve the mass production and practical use of embodied robotics.

AgiBot specializes in the development, mass production, and commercial deployment of such robots which have AI integrated onto them.

These robots are deployed across a wide range of commercial scenarios, including production lines, logistics sorting, security, education, and even entertainment purposes.

To date, the full-size embodied robot AgiBot A-Series has achieved mass production with 1,742 units. Meanwhile, the AgiBot X-Series, an agile half-size robot, has reached 1,846 units.

Lastly, the task-optimized AgiBot G-Series, designed for more complex operations, has reached 1,412 units.

Through widespread adoption across multiple industries, AgiBot is demonstrating the potential of embodied AI to drive industrial upgrades, transform service and production processes, and support broader digitization efforts.

Just recently, AgiBot has successfully deployed its Real-World Reinforcement Learning (RW-RL) system on a pilot production line with Longcheer Technology.

AgiBot’s RW-RL system addresses pain points in production lines such as relying on rigid automation systems. The robots learn and adapt directly on the factory floor.

And in just minutes, robots can acquire new skills, achieve stable deployment, and maintain long-term performance without degradation.

In addition, the system also autonomously compensates for common variations such as part position and tolerance shifts.

Enterprise

Paramount just made a $108-billion counteroffer for Warner Bros.

Netflix’s offer is just for $82 billion.

Late last week, “Netflix bought Warner Bros.” was a sentence often bandied around. The truth was, as always, far less glamorous. Netflix hasn’t bought the entertainment giant just yet. Rather, it just extended a lucrative offer, which gives other suitors and regulating agencies a chance to respond. And respond, they have. Paramount has just made a sizable counteroffer for Warner Bros. Discovery, totalling US$ 108.4 billion in value.

Much like last week’s report, the wording is crucial here. Netflix made an offer for Warner Bros. Paramount is making an offer for Warner Bros. Discovery.

Netflix’s offer of US$ 82.7 billion (or US$ 27.75 per share) hinges on Warner Bros. Discovery un-merging and forming two separate entities: the Warner Bros. arm and the Discovery arm. Netflix plans to buy the former, while the latter (along with its associated networks) will be free to break off into its own ventures. Should it be approved, the deal will be inked only starting around the latter half of next year.

On the other hand, Paramount wants everything, including the cable networks. It’s willing to pay US$ 30 per share, or US$ 108.4 billion.

The company counters that Netflix’s offer is “based on an illusory prospective valuation of Global Networks that is unsupported by the business fundamentals and encumbered by high levels of financial leverage assigned to the entity.”

The company further says that their previous six bids were never seriously considered by Warner Bros. Discovery, whereas the latter reached a unanimous decision with Netflix.

In terms of value, Paramount promises a combination of Paramount+ and HBO Max, as well as an infusion of sports like the NFL and the Olympics.

Though Paramount’s price is much higher than Netflix, it must also go through an approval process. It will expire on January 8, 2026.

-

Accessories1 week ago

Accessories1 week agoRazer teams up with BLACKPINK for limited-edition gear

-

News1 week ago

News1 week agoHONOR WIN headlines the first 10,000mAh smartphone with built-in fan

-

Editors' Choice2 weeks ago

Editors' Choice2 weeks agoFavorite Laptops of 2025

-

Automotive2 weeks ago

Automotive2 weeks agoInside the Next-Gen Ford Ranger Wildtrak 4×4

-

News1 week ago

News1 week agoXiaomi 17 Ultra debuts as 2025’s last full-fledged flagship

-

Reviews2 weeks ago

Reviews2 weeks agoiQOO 15 review: Made for players who take performance seriously

-

Editors' Choice2 weeks ago

Editors' Choice2 weeks agoFavorite Wearables of 2025

-

Gaming2 weeks ago

Gaming2 weeks agoFavorite Games of 2025