Apps

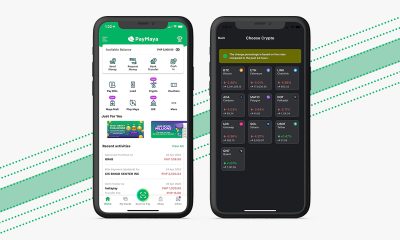

Philippine government partners with PayMaya for cashless transactions

Get cashback when you pay your government dues and fees

More than ever, cashless transactions are now essential to our daily lives. It’s safe, contactless, and convenient; paying anything with just a single tap on your smartphone.

This is why the Philippine government partnered with PayMaya, one of the leading digital financial services in the country, to enable cashless payments — via cards and e-wallet payments — to government transactions.

Recently, PayMaya has just added more government agencies to its growing roster:

- Land Transportation Office (LTO)

- Securities and Exchange Commission (SC)

- Intellectual Property Office of the Philippines (IPOPHL)

- Optical Media Board (OMB)

- City of Taguig

The aforementioned is an addition to more than 50 government agencies and local government units, such as the following:

- Bureau of Internal Revenue (BIR)

- Social Security System (SSS)

- PAG-IBIG Fund

- Bureau of Customs (BOC)

- Department of Foreign Affairs (DFA)

- Department of Trade and Industry (DTI)

- Professional Regulation Commission (PRC)

- National Home Mortgage Finance Corporation (NHMFC)

- City of Valenzuela, Ormoc City, Parañaque City, and more

Safe and transparent transactions

Through PayMaya, Filipinos can continue their lives and handle government transactions safely. With reduced cash handling and interaction with other people in physical locations, Filipinos can lessen the chance of contracting COVID-19 and in essence, help curb the COVID-19 cases.

These digital payment methods also help the government. Through their online and physical touchpoints offering cashless payments, government agencies and units can have more efficient operations and better transparency in transactions, while also reaching more constituents in and outside the country.

Get cashback when you use PayMaya

PayMaya offers cashback on transaction fees when you use your PayMaya-registered mobile number to pay your government fees and dues until September 30, 2020.

You can enjoy a cashback voucher through select online and mobile government channels such as the websites of DFA, PRC, NHMFC, JUANTAX, Taxumo, the Construction Industry Association of the Philippines, and the mobile app of SSS.

The cashback voucher will be sent to you via PayMaya’s app and amounts equal to the transaction fee collected by the agency.

PayMaya can be downloaded via Google’s Play Store, Huawei’s AppGallery, and Apple’s App Store.

New users on X might soon face a tough time on the platform. The social media website will likely start charging new accounts a small fee for the right to post on the platform.

Now, the fee isn’t a new one. Almost six months ago, the company tested the paid system in New Zealand and the Philippines. New users in those countries had to pay a dollar per year for the ability to post and reply to content.

As spotted by X Daily News on the same platform, the company might be ready to take the experiment to a larger market. New text strings have shown that the policy is rolling out worldwide.

SPECULATION: X might be expanding its policy to charge new users before they reply/like/bookmark a post https://t.co/odqeyeiHBx pic.twitter.com/EU71qlwQ0D

— X Daily News (@xDaily) April 15, 2024

The policy is designed to combat a wave of bots appearing on the platform. By preventing new accounts from creating posts, X hopes to stave off the standard behavior of bots these days. You might have noticed them as OnlyFans creators in unrelated posts, peddling NSFW content on their bio.

Though the global rollout was only just spotted, owner Elon Musk has seemingly confirmed the change. Replying to X Daily News, Musk says that it is “the only way to curb the relentless onslaught of bots.” He says that the current breed of bots can easily bypass simple checks these days.

Apps

Disney+ might get always-on channels similar to cable TV

Featuring content from Marvel, Star Wars, and classic Disney

The burden of choice on streaming platforms is real. If you’re like us, you’ve spent hours just mindlessly scrolling through titles on Netflix or Disney+ without watching anything. Netflix, at least, has a Play Something button to fight off that irresistible urge. Now, Disney+ is reportedly trying something different: always-on channels.

If you already cut cable from your lives, you’re likely missing traditional channels or networks that have pre-determined programming. It was a flawed system that eventually ended up with mediocre content and a downpour of ads. However, cable did allow us to keep watching without deciding what comes next.

Now, according to The Information, Disney+ is working on adding those channels to its streaming service. Naturally, these channels will include content from the platform’s library such as Marvel, Star Wars, and its list of classic animated films.

Strangely, the reported feature might still have ads in between programs. Though the addition of ads does mean a better similarity with real television, users still have to be paying subscribers to access the channels. Even if you’re already paying for Disney+, you might still get hit with ads.

Disney has not confirmed the reports yet. The platform might launch a version of the feature outside of the scope included in this report. It’s also unknown when these always-on channels will launch.

SEE ALSO: Macross to be available on Disney+

A few years ago, Apple unleashed one of the most interesting features for the iPhone today: Emergency SOS. Designed for those who like their fair bit of the outdoors, Emergency SOS allows users to contact emergency services without network coverage. Other manufacturers, however, are struggling to adopt the same feature. Now, Google might soon join Apple in providing satellite connectivity for its users.

Despite the convenience, satellite connectivity hasn’t taken off as much as the industry expected it to. For one, a network of satellites isn’t the easiest thing to maintain. Apple is still currently offering its services for free, a gamble that may or may not pay off. Now, the iPhone maker won’t be alone.

According to Android Authority, Google might start offering the same service to Pixel 9 users. Starting with this year’s upcoming flagship, the company is reportedly teaming up with T-Mobile to create satellite connectivity for its users. The telecommunications network is teaming up with SpaceX for the feature.

The same report describes how the feature might work. Once activated, the feature will ask users of their situation: is everyone breathing, are people trapped, are weapons involved, among others. The phone will then relay this information to emergency authorities for a rapid response.

Unfortunately, pricing remains a mystery. While Apple is still offering its satellite connectivity for free, other brands might put the burden of cost on the end user. Hopefully, they won’t, but a paid version is unfortunately expected at this point.

SEE ALSO: Should you be excited for Apple’s satellite connectivity?

-

Events2 weeks ago

Events2 weeks agoStellar Blade: PlayStation taps cosplayers to play Eve for game’s launch

-

Features1 week ago

Features1 week agoFortify your home office or business setup with these devices

-

Accessories2 weeks ago

Accessories2 weeks agoLogitech unveils G Pro X 60 gaming keyboard: Price, details

-

Reviews1 week ago

Reviews1 week agorealme 12+ 5G review: One month later

-

Deals2 weeks ago

Deals2 weeks agoTCL P635 TV: Big savings for TCL’s anniversary

-

Gaming1 week ago

Gaming1 week agoNew PUMA collection lets you wear PlayStation’s iconic symbols

-

Accessories1 week ago

Accessories1 week agoMarshall Major V: Reasons Why I Love It

-

Gaming1 week ago

Gaming1 week agoMore PlayStation 5 Pro specs have been leaked