Enterprise

Huawei loses TSMC as chip supplier

Another one bites the dust

Back in May, the US pondered on a new type of ban for Huawei, one year after the first bombshell dropped for the Chinese company. Besides banning American companies from doing business with Huawei, the American government also implemented a ban on international companies relying on American technologies from selling to Huawei. Though potentially crippling Huawei’s chip-making business, we didn’t know how the new ban would affect current suppliers at the time.

Now, one of the affect suppliers, Taiwan Semiconductor Manufacturing Co. (TSMC), has issued an official statement about the new ban, reported by Nikkei Asian Review. Apparently, the company has stopped taking in new orders from Huawei since May 15, right when the ban was first instated. Further, they are planning to conclude all current deals with Huawei by September 14.

For TSMC, the ban is a huge speed bump. Huawei is (or was) one of the company’s key clients, supplying wafers for Huawei’s chip-making branch, HiSilicon. Currently, HiSilicon relies on other components to produce Kirin chipsets.

Despite the loss, TSMC remains optimistic about filling in the gap left by Huawei. According to reports, the company is still posting more than 20 percent revenue growth this year because of increasing 5G demand.

Still, if TSMC wants to retain Huawei, the company can apply for an operating license from the US. TSMC has not confirmed whether it has applied for such a license. For now, Huawei is banking on ongoing orders and their stockpiles to weather the storm of dwindling sources.

SEE ALSO: UK officially bans Huawei

Enterprise

Sony teams up with 13 companies for sustainable global supply chain

Sustainability through introduction of renewable plastics

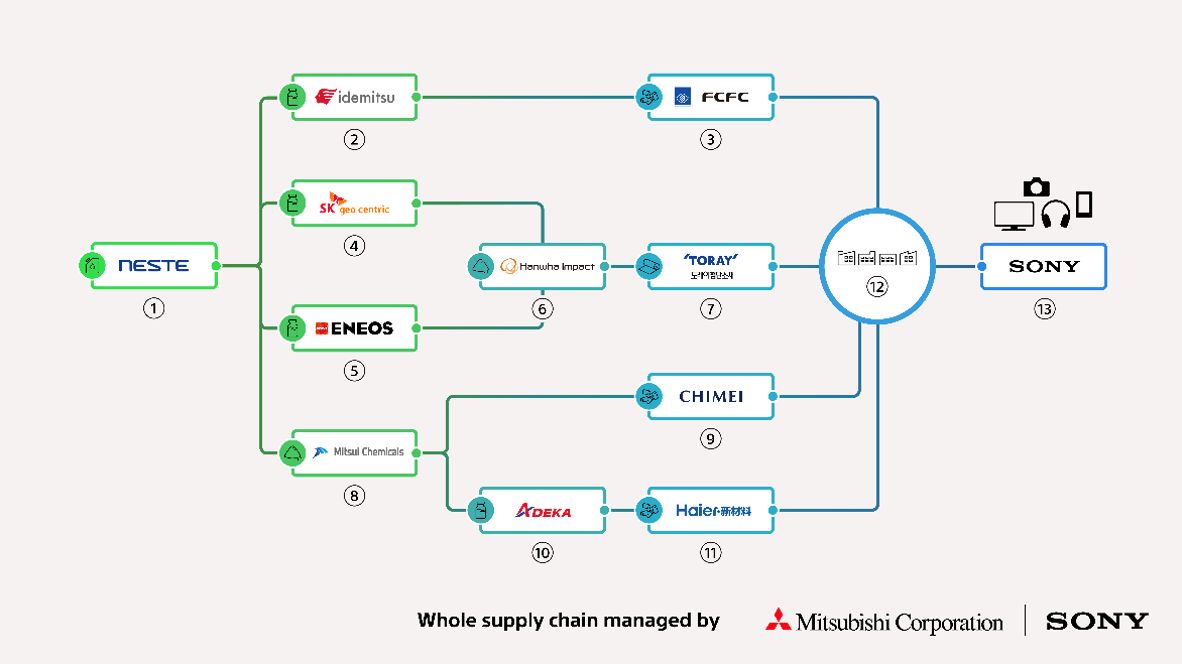

Sony, along with several companies, have established the world’s first global supply chain for the production of renewable plastics that can be used in Sony’s high-performance audiovisual products.

The supply chain consists of 14 companies across five countries and regions. The various plastic materials manufacture through this supply are slated for use in Sony’s products that will launch worldwide.

High-performance products such as audiovisual equipment involve a wide variety of plastics. The result is a complex supply chain that makes it difficult to visualize and manage the entire flow.

Additionally, plastic components that require high performance in terms of flame resistance and optical properties cannot be fully replaced with plastics from material recycling.

To address these challenges, these 14 companies have collaborated to visualize the existing supply chain for Sony’s products:

- Sony Corporation

- Mitsubishi Corporation

- ADEKA CORPORATION

- CHIMEI Corporation

- ENEOS Corporation

- Formosa Chemicals & Fibre Corporation

- Hanwha Impact Corporation

- Idemitsu Kosan Co., Ltd.

- Mitsui Chemicals, Inc.

- Neste Corporation

- Qingdao Haier New Material Development Co.

- Ltd., SK Geo Centric Co., Ltd.

- Toray Industries, Inc.

- Toray Advanced Materials Korea Inc.

Sustainability through renewable plastics

The new supply chain created will enable the production of multiple types of renewable plastics from biomass resources with a mass balance approach.

This allows Sony to proactively source raw materials for its products with quality, as well as properties equivalent to virgin fossil-based plastics.

Defining the supply chain also helps the companies track and document GHG (Greenhouse Gas) emissions data in a verifiable way.

This allows participating companies to leverage the data to advance efforts to reduce their carbon footprint going forward.

Sony’s initiative with a wide range of global partners is part of the “Creating NEW from reNEWable materials” jointly launched by the electronics giant and Mitsubishi.

It aims to achieve zero usage of virgin fossil-based plastics through the introduction of renewable plastics.

Enterprise

realme is reportedly going back to being an OPPO sub-brand

All scheduled phones will still launch on time, though.

A popular story among Chinese smartphone brands is whenever a sub-brand spinning off into its own independent entity. A less common one is when an independent entity suddenly merges back into the main entity. And yet, that’s the story we have today. realme is reportedly going back to being a sub-brand of OPPO.

If you don’t remember realme’s time as a sub-brand, then it’s hardly your fault. It’s been a long while since realme was considered a sub-brand. In 2018, the brand spun off on its own to form one of the most popular names in the Chinese smartphone space.

Today, via Leiphone, realme will return to OPPO as a sub-brand. Current realme CEO Sky Li will still retain his responsibilities heading the brand. Plus, all products on the current release schedule will still come out as planned.

However, starting this year, realme will start reintegrating back into OPPO, particularly through the latter’s after-sales programs. OnePlus will also follow the same structure going forward.

Currently, realme has not officially announced the move. That said, we also don’t know how the brand will address the reported change. It’s possible that the shift is just internal and has no effect on how the brand faces the public. For now, only time will tell.

SEE ALSO: realme C85 with 7000mAh battery, 5G connectivity officially launches

The big story late last year was the skyrocketing prices of chips. Analysts are predicting that the demand for RAM will cause the entire industry to experience hikes this year. Some users, especially in the PC building scene, are already feeling the burn. PCs won’t be the only victims, though. Xiaomi is already expecting hikes across the board. Now, Samsung is adding its voice to the growing list of warnings about price increases.

During CES 2026, Wonjiun Lee, Samsung’s global marketing chief, confirmed that the memory shortages are, in fact, real (via Bloomberg). Moreover, the company is now evaluating whether more price hikes are needed this year for its products. Though Lee expressed regret over pushing the prices to consumers, the state of the industry might force the company’s hand.

Samsung’s opinion has a lot of weight. While other brands have also voiced out their opinions lately, Samsung itself is a producer of chips. If a chip supplier is already warning users of prices affecting them, the effect will likely cascade even more when it comes to device manufacturers.

The ongoing shortage of chips is a result of the overwhelming demand from companies looking to build and bolster AI-based servers. The business-to-business demand is notably different from how regular consumers, who will soon find it hard to buy their own devices, see it.

At the very least, Samsung has not confirmed any price increases yet. However, all eyes are on the next Galaxy Unpacked, when Samsung will launch its newest Galaxy products. Will prices increase or stay the same?

-

Apps2 weeks ago

Apps2 weeks agoBreaking up with Adobe Photoshop after 20 years

-

Gaming2 weeks ago

Gaming2 weeks agoPlayStation, LE SSERAFIM Chaewon team for the ‘Love of Play’ campaign

-

Accessories1 week ago

Accessories1 week agoSony WF-1000XM6 was accidentally leaked online

-

Reviews1 week ago

Reviews1 week agonubia V80 Max: Long battery, marginal upgrades, casual budget phone

-

Gaming2 weeks ago

Gaming2 weeks agoZenless Zone Zero Version 2.6 launches February 6 with idol group debut

-

News3 days ago

News3 days agoTECNO will showcase the CAMON 50 and POVA 8 series at MWC 2026

-

Gaming1 week ago

Gaming1 week agoMy Hero Academia: All’s Justice: A familiar Final War, made playable

-

Gaming1 week ago

Gaming1 week agoNew Civilization VII update will address everyone’s biggest issue